Welcome to the July issue of The Hedge!

In this issue, we’ll review the Q2 Insights Report, the latest NMPIP vote outcomes, and the current NMDP Snapshot vote. Over the last month, members have discussed and voted on NMPIPs focused on Capital Pool investment allocations.

In this issue, we also invite members to participate in our surveys and reading groups, as well as provide feedback on our governance research project. You can also find an overview of new cover listings.

Let's dive in.

Calls to Action 🗳️

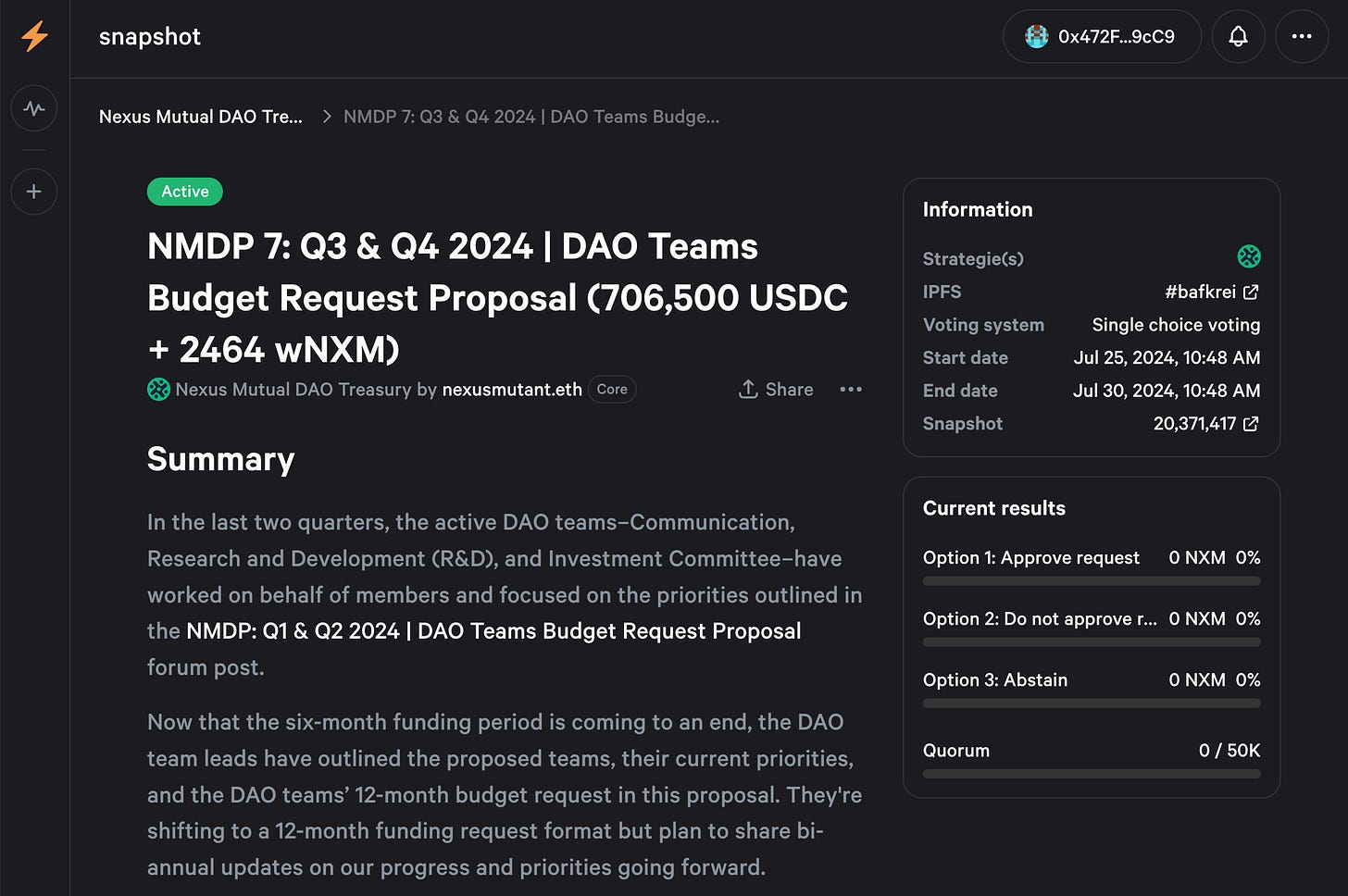

Vote on NMDP 7: Q3 & Q4 2024 | DAO Teams Budget Request Proposal

The DAO teams are requesting 706,500 USDC + 2464 wNXM to fund the next 12 months of operations. The DAO currently consists of the Community, Research & Development (R&D), Investment, Marketing and Product & Risk teams. Each team has highlighted their purpose, past performance and upcoming priorities in the NMDP 7: Q3 & Q4 2024 | DAO Teams Budget Request Proposal post on the governance forum.

You can review the proposal and cast your vote on Snapshot from 25 July until 30 July.

Participate in Our New Product Survey

The DAO Product & Risk team is developing a new cover product, and they’re looking for your feedback! If you’re a DeFi user of any experience level, we’d like to hear from you. Especially if you regularly use protocols on Base, Arbitrum, Optimism and other Layer 2s.

This new product survey takes only a few minutes. Your input is valuable and will help us bring this new flexible cover product to market!

Please fill out this short survey and provide us with your feedback.

Share Insights with the Governance Research Team

The DAO R&D and Community teams are exploring new onchain governance designs to ensure sustainable long-term participation and the Mutual can move quickly since the DeFi landscape is always changing.

Our goal is to establish an optimistic governance structure where the Foundation and DAO teams can propose changes in an onchain vote, which could be vetoed by an all-member vote to ensure members can block controversial proposals. We aim to include different types of organizations and several levels of decision-making in our governance. Our focus is on creating strong protections against harmful actions, ensuring that the DAO, Foundation teams, and Advisory Board are held responsible for their actions, and effectively managing unexpected crises.

We welcome feedback, resources, and examples from recent optimistic governance implementations. Please reach to Sem on Discord with any ideas or experiences.

Join the Governance Reading Group

The governance reading group is made up of Mutual members and people interested in governance research and practice. The group is currently reading Governable Spaces by Nathan Schneider. Our next discussion will be held online, at 15 GMT on 2 August 2024, where we’ll discuss the fourth chapter, Governable Stacks: Organizing against Digital Colonialism.

If you’d like to read along with us, you’re more than welcome! Reach out to us through Discord or by replying to the forum thread.

Recent Highlights 👓

Q2 Insights Report, presented by the DAO Community Team

The DAO Community Team has used data sourced from the Dune dashboards maintained by the DAO R&D team to review and analyze the Mutual’s performance during Q2.

Highlights from the Report

In Q2, Nexus Mutual members sold cover worth $167.9M+, an increase of ~223% from Q1 2024.

The DAO generated over $193K in commissions. This showcases the earning potential for teams interested in building distribution platforms for the Mutual’s cover products.

Members purchased 6.5x the amount of Bundled Protocol Cover in Q2 than they did in Q1. With Bundled Protocol Cover sales surpassing $49.4M and cover fees exceeding $649K, this new cover product contributed more than half of the total cover fees earned in Q2.

Capital Pool investments generated $1.42M+ in earnings for members.

The Mutual’s Net Cash Flow exceeded $2.7M.

The Ratcheting AMM (RAMM) earned members $1.4M+ through buybacks in Q2.

We’re pleased to see continued growth in Q2, new cover products, and strong partnership development. For more information, please refer to the Q2 Insights Report on the Nexus Mutual Governance Forum.

If there’s any update you’d like us to provide in the next quarterly report, please reach out to Sem on Discord! 🐢

Review of Recent Governance Vote Outcomes

NMPIP 228: Allocate 6,575 ETH to Chorus One and Ether.fi

The DAO Investment Committee worked with the Avantgarde and Ether.fi teams to discuss potential allocation strategies for the 6,575 ETH available in Nexus Mutual’s Enzyme vault. These discussions resulted in the RFCs and the subsquent NMPIP on the governance forum during the last month.

After the RFCs were both posted for a two-week period, the Investment Committee posted a Snapshot signaling vote, where members signalled their support for allocating:

4,989 ETH to Chorus One via Stakewise V3

1,586 ETH to EtherFi by acquiring weETH

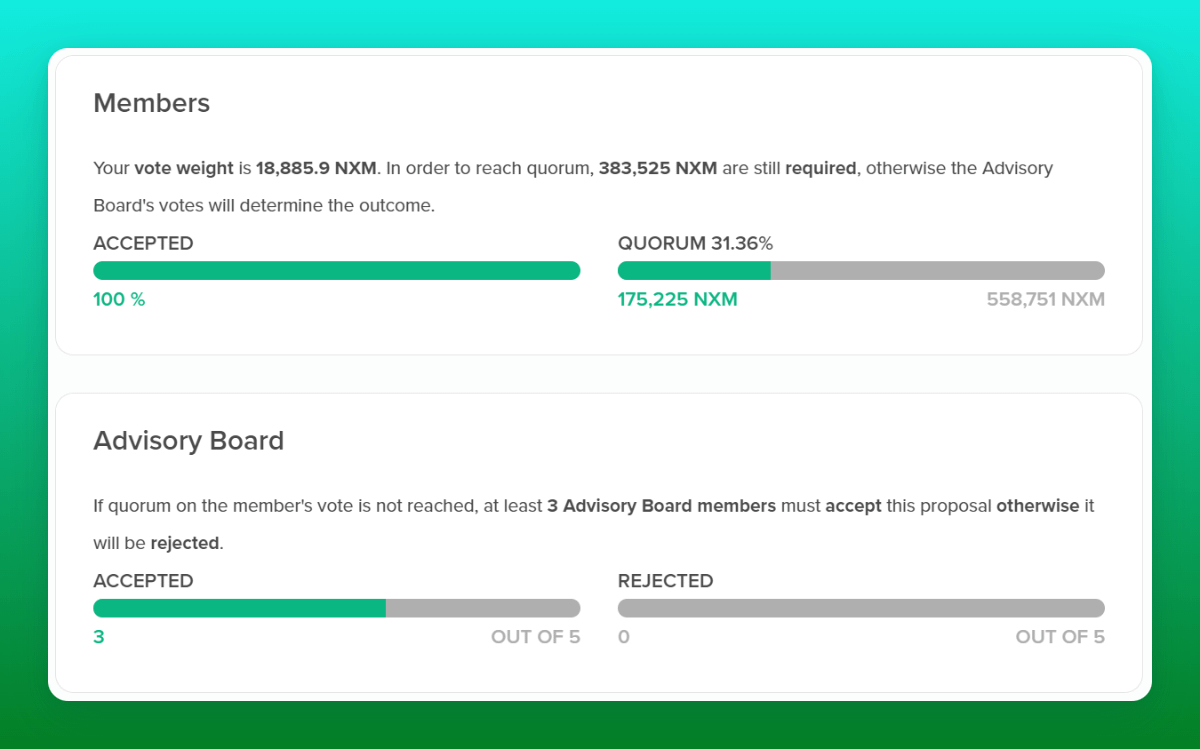

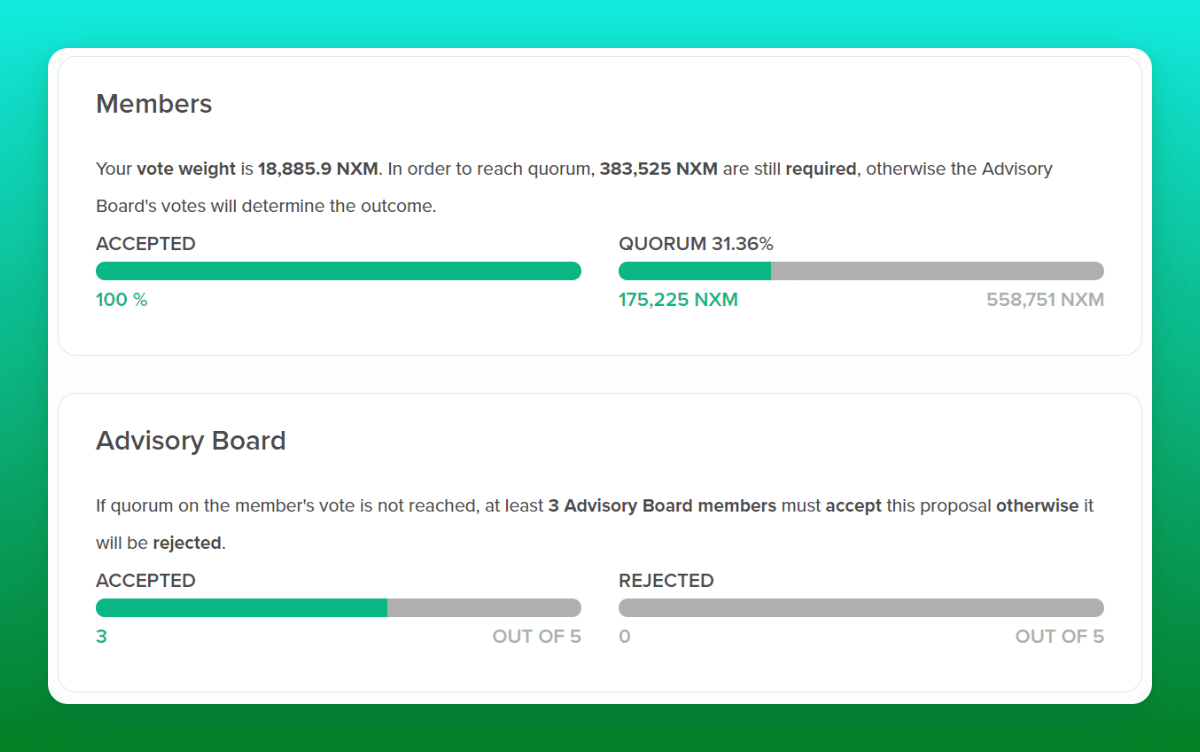

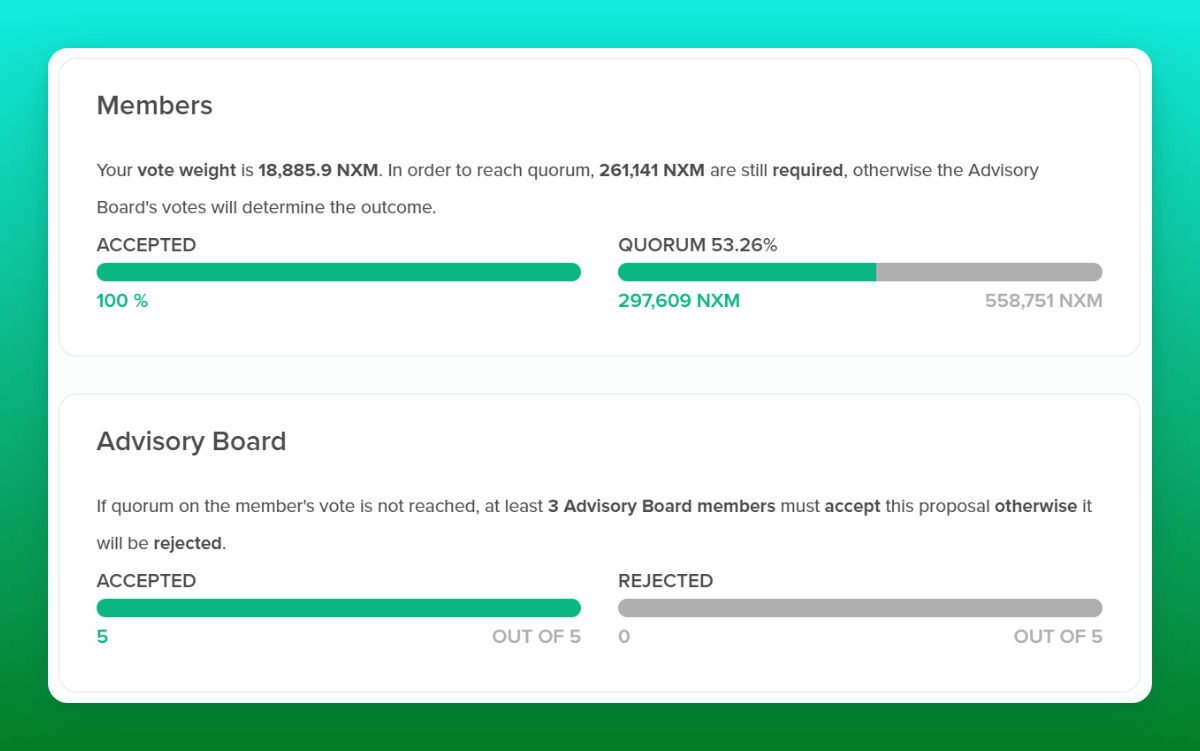

The Investment Committee used the results of the signaling vote to create the Nexus Mutual Protocol Improvement Proposal (NMPIP) 228: Allocate 6575 ETH to Chorus One and Etherfi, which was posted on the governance forum and open for review for several weeks before moving to an onchain vote. The voted closed on 21 July 2024, with members voting to approve the proposal. You can see the final result of the vote below.

The next step is for the Avantgarde team to execute the investment allocations based on the outcome of this vote.

NMPIP 227: Aave V3 Loan Repayment and Liquidation Policy

The Investment Committee proposed a strategy for repaying the Cover Re-associated Aave loan and increasing collateral to avoid liquidation in the event the price of ETH drops in the future.

The proposed actions include repaying parts of the loan using excess stablecoins in the Capital Pool above a $1 million threshold. Additionally, the aEthWETH collateral will be topped up with 3,000 ETH at specific ETH/USD price thresholds: $1600, $1250 and $1000.

An emergency repayment may be executed if the ETH/USD price drops below $500, at the discretion of the Advisory Board. See the NMPIP on the forum for the complete details of the proposal.

The vote closed on 21 July 2024, with members voting to approve the proposal. You can see the final result of the vote below.

NMPIP 225: Divestment Framework

The Investment Committee proposed establishing a Divestment Framework to create capital targets for ETH and stablecoin assets held in the Capital Pool. The framework will be used to ensure there’s always ETH and stablecoin assets held in the Capital Pool to honor future Ratcheting AMM (RAMM) redemptions and ensure all claims can be paid. The targets outlined in NMPIP 225 are $1M in stablecoins and 12.5K ETH.

The vote closed on 14 July 2024, with members voting to approve the proposal. You can see the final result of the vote below.

New Listings in the Nexus Mutual UI

Since the June issue of The Hedge, the Product & Risk Team added 12 new listings to the Nexus Mutual UI.

Protocol Cover Listings

Inverse Finance FiRM Protocol Cover

Inverse Finance sDOLA Protocol Cover

Curve LlamaLend Protocol Cover

Ramses Exchange Protocol Cover

Credit Guild Protocol Cover

Reserve Protocol Cover

Contango Protocol Cover

Bundled Protocol Cover Listings

Ether.fi Liquid King Karak LRT Vault Bundled Protocol Cover

Beefy CLM + Velodrome Bundled Protocol Cover

Beefy CLM + Aerodrome Bundled Protocol Cover

Beefy CLM + Camelot Bundled Protocol Cover

Beefy CLM + Pancakeswap Bundled Protocol Cover

If there’s a Protocol Cover or Bundled Protocol Cover listing you’d like to see added, reach out to us on Discord or send us a message through the Contact Form with your request for our Product & Risk Team to evaluate.

Thanks for reading, and see you next issue! 🐢

We look forward to seeing you at our next Community Call on 30 July 2024 on X. Set yourself a reminder, so you don’t miss the call!

In early August, there’ll be a special issue for The Hedge where we’ll share highlights from our updated team roadmap. Stay tuned!

If you have any questions, reach out to us on the Nexus Mutual Discord.

Resources

You can find the latest updates from the Nexus Mutual community below:

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below: