Nexus Mutual Newsletter | 11 April 2022

Start your week off right by catching up on the latest updates from Nexus Mutual and stay up-to-date on the upcoming events later this week and month.

If you didn’t notice last week, we have moved our weekly Nexus Mutual Newsletter to a Monday morning release. Start your week off right by catching up on the latest updates from Nexus Mutual and stay up-to-date on the upcoming events later this week and month.

Let’s jump into another alpha-packed issue of the Nexus Mutual Newsletter!

Certora Presentation

On Tuesday (29 March), Certora, a leading provider of security analysis tools for smart contracts, featured Hugh Karp in their seminar series. Hugh spoke about the risks the mutual is monitoring and which risks have the greatest potential impact within DeFi.

Certora shared the recording on Twitter last week. Hugh shared some timely thoughts, as his discussion on cross-chain bridges took place 30 minutes after the Ronin Network made their massive security breach public.

In his presentation, Hugh reviews risks related to:

Cross-chain bridges, protocols

Layer 2 solutions

Smart contract integrations/interfaces

Decentralized governance + contract updates

Listen to the recording here 👇

Mutant Marketing + Nexus V2

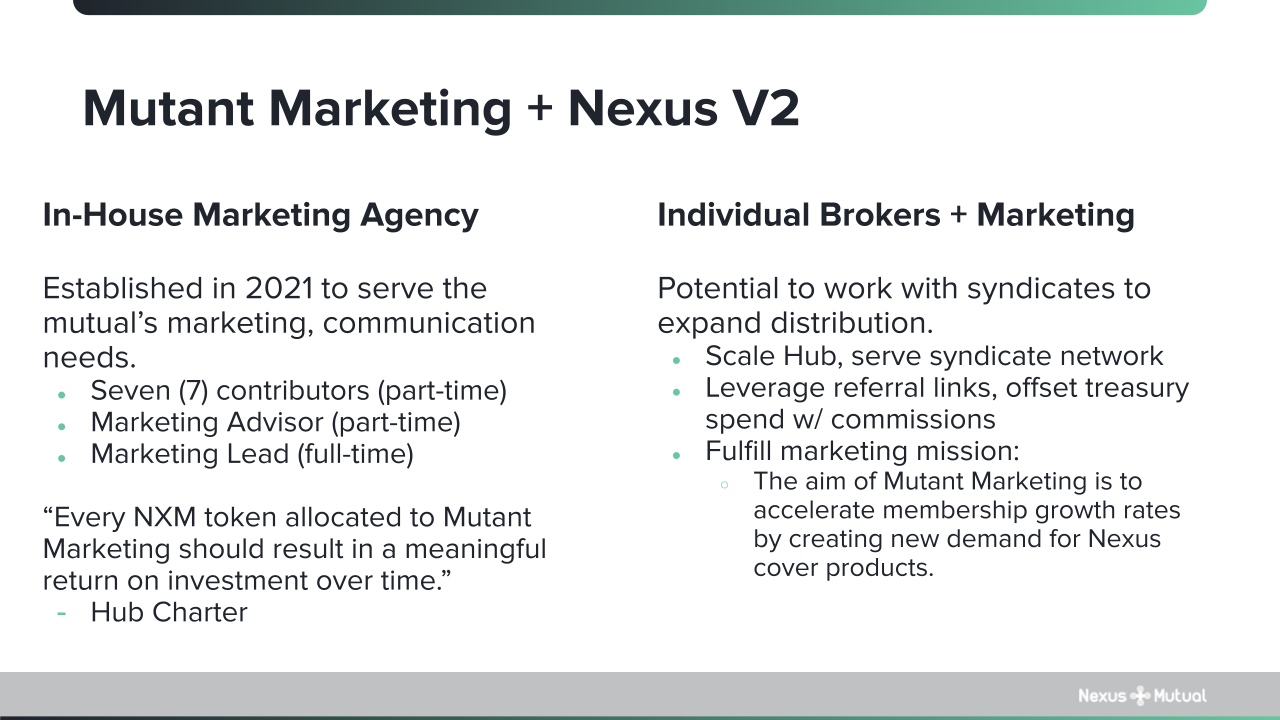

During last week’s Mutant Meetup call, I reviewed Mutant Marketing’s progress on our key results to date and shed some light on how we are tracking key results one (1) and three (3). Now that I have reviewed the fundamentals and functionality coming with Nexus V2, I wanted to provide our community with my view of Mutant Marketing’s direction over the next year or so.

Just as Nexus V2 unlocks new opportunities and potential for the mutual, V2 also creates new possibilies for Mutant Marketing.

Currently, Mutant Marketing is staffed by seven (7) part-time contributors and myself, the sole full-time contributor. As time goes on, I plan to hire new contributors and realize the vision of an in-house creative agency that handles the mutual’s marketing, communication, and community engagement needs. To effectively scale, I will create OKRs for where I want our Hub to be in a year’s time and plan accordingly. The vision I have is no small feat.

In Nexus V2, the mutual will become an on-chain market for risk powered by the syndicate network, a variety of subDAOs managing capital, underwriting and distributing cover using the mutual’s infrastructure as the base layer. Each of these subDAOs will operate independently from the mutual, though all will require marketing and communications services.

There is no one agency that understands the value proposition of the mutual better than our in-house agency.

Mutant Marketing can serve the mutual and support the syndicate network, while using referral links to generate commissions, which would be directed to the Mutant Marketing multi-sig. Commissions earned from referral links would allow us to reduce our treasury spend, become more self-sufficient, and deliver greater value to members of the mutual.

On 2 August 2022, Mutant Marketing will hit our one year mark. At that time, I plan to share more details on our OKRs and direction for our two year milestone, 2 August 2023.

To hear my review of Mutant Marketing + Nexus V2 on this week’s call, listen to the recording here.

Interested in learning more about syndicates?

Over the last several weeks, I have shared an Overview of Nexus V2 and all of the functionality and features V2 will bring to the mutual.

One of the core improvements to the mutual: the syndicate network—a variety of subDAOs that manage capitial, determine staking allocation/weight, and set pricing for cover products. Those who run syndicates earn management fees.

Protocols and platfroms that provide frontend integrations that allow users to buy cover at the point of sale can earn commissions on every cover purchased through a direct integration.

Are you a member with risk expertise that would like to learn more about the different types of syndicates? Would you like to hear more about commissions and frontend integrations?

If so, you can fill out the Nexus V2 Syndicates Google Form and I (BraveNewDeFi) will be in touch!

Mutant Meetup Call | 5 April 2022

During this week’s core team update, Hugh provided an overview of ongoing initiatives and projects happening within Nexus.

While the core team’s focus remains on Nexus V2, the engineering team is looking to hire more developers in order to scale the team. At the moment, the team is reviewing applications but no hiring decisions have been made as of yet. A Nexus V2 update: the team is making considerable progress, as they test the V2 code and prepare for audit.

Hugh also shared some insights on the tokenomics/bonding curve working group’s progress to date. One of the current ideas the working grouup has been evaluating—the use of bonds (i.e., discounts) to incentivize capital acquisition within the mutual. The preliminary model being discussed would move away from a defined MCR floor and transition to a dynamic model that would allow members to exit at book value after a predefined timeframe.

With this model, members would still need to ensure there is sufficient capital held in the pool to satisfy claims and underwrite cover. This preliminary model being discussed would allow members to exit at book value, so wNXM could take over from NXM price. However, this is an ongoing discussion among tokenomics/bonding curve working group members and the model is still subject to change. Anyone can get involved and join the group, if they would like to contribute.

Hugh also provided an update on the Investment Hub’s view of potential investment strategies going forward.

There were a lot of updates in this week’s Mutant Meetup call. To listen to Hugh’s core team update and the rest of the updates on the call, listen to the recording here.

Members can always listen to past recordings in the Mutant Meetup archive in the docs.

Call for Tokenomics Working Group

The disparity between wNXM and NXM has not gone unnoticed within the Nexus Mutual community. It’s been a point of frustration for many, but our community is filled with smart, skilled contributors who have formed a working group to discuss potential changes to NXM tokenomics or modifications to the bonding curve design. This conversation started on the Nexus Mutual forum.

While the core team is focused on shipping Nexus V2, which will significantly improve the protocol and widen our distribution network, our community is hard at work on addressing the wNXM issue. When our community works together, we can accomplish anything.

If you are interested in joining the tokenomics working group, reach out to Jack (Dopeee).

Review of Cover Sales (28 March to 3 April 2022)

D1Conf Session Themes Announced

On Thursday (7 April), the session themes were announced for the Decentralized Insurance Conference (D1Conf):

Real world risks, emerging markets

On-chain economic infrastructure

Massive adoption

To date, there has been an influx of requests to present and attend the conference. Look out for an announcement on the final speaking lineup for the D1Conf later this week. For more details on this year’s D1Conf, members can read the announcement here.

Upcoming Conferences + Presentations

Decentralized Insurance Conference (D1Conf) | 21 April

Nexus Mutual is co-hosting the 4th annual D1Conf with the Etherisc team!

This event will focus on the advancements being made in blockchain insurance markets, economic/distribution models, and the evolving regulatory landscape.

Secureum TrustX Security Conference | 21-22 April

Hugh Karp will be speaking during the the TrustX security conference during Devconnect.

The mutual is always closely watching as new risks emerge in DeFi, and Hugh will talk about the advancements in the on-chain tech stack and evolving risks in DeFi at the first ever TrustX security event.

PlannerDAO Crossroads Conference | 25-26 April

Nexus Mutual is the title sponsor of this year’s PlannerDAO Crossroads conference!

Both Hugh Karp and BraveNewDeFi will be presenting at the inaugural Crossroads conference—an event that will explore the direction the current digital shift is taking us as the gap between traditional ways and digital adoption is widening in the financial industry.

Weekly Close

In this next week, we’ll be hosting:

Our Mutant Meetup call on Tuesday (12 April) at 10am EST / 2pm UTC on Discord in the Community Calls Voice channel.

You can follow the Nexus Mutual Twitter account for regular updates and communication from the mutual, and you can follow the Nexus Mutual Bot Twitter account to stay up to date on cover buys as they happen.

Have a great weekend and week ahead 🐢

Resources

Nexus V2 Review