Nexus Mutual Newsletter | 19 October 2022

This newsletter is brought to you by BraveNewDeFi and Sem Turan on the Nexus Communications team. Stay up-to-date on the latest news and updates from the Nexus Mutual community.

Highlights

Update: $wNXM buyback with $LDO

Members voted to use LDO holdings to buyback wNXM below book value after Vincent Weisser’s initiated the Buyback $wnxm with $ldo $gal discussion and Snapshot proposal.

After members voted in favor of this proposal, the Nexus Treasury executed the buyback using LDO holdings.

💸 Total LDO sold: 107,367.47

💰 Total wNXM acquired: 8,494.231

📚 Book value of acquired wNXM: 192.71 ETH

Community Call on 18 October

Nexus Mutual Discord, Community Calls Voice Channel

On this week’s community call, BraveNewDeFi reviewed the community highlights and governance proposals. Afterwards, Hugh shared his weekly team update, which is summarized below.

The engineering team with support from the BootNode team is hyper-focused on Nexus v2. They are currently working through minor edge cases and continue to test the Nexus V2 codebase. The mutual’s engineering team is continuing to expand, as the team has hired another Solidity developer.

Rei is finalizing his work on the first version of the new tokenomics model. Members can expect to review and provide feedback within the next week.

The team is in discussions with parties about ETH Staking Cover. Look for announcements in the future.

If you couldn’t join us on the call this week, you can listen to this week’s community call recording on the Nexus Mutual YouTube channel.

Governance forum discussions and proposals

Snapshot vote: Allocate $SAFE to buyback $wNXM

Vincent proposed using SAFE holdings to buyback wNXM below book value.

If SAFE is worth above 0.7$, propose to sell 50% for wNXM

If SAFE is worth above 1$, propose to sell the other 50% for wNXM

With this vote, Vincent’s goal is to achieve soft consensus on how the mutual will use our SAFE holdings once it does become transferable.

After an open comment and review period, the choices presented on Snapshot are:

Yes, buyback wxnm

No

Be sure to review and vote on this Snapshot proposal:

This proposal will open for voting on 12 October at 1:02am EST / 5:02am UTC and it will be closed for voting on 20 October at 1:00pm EST / 5:00pm UTC.

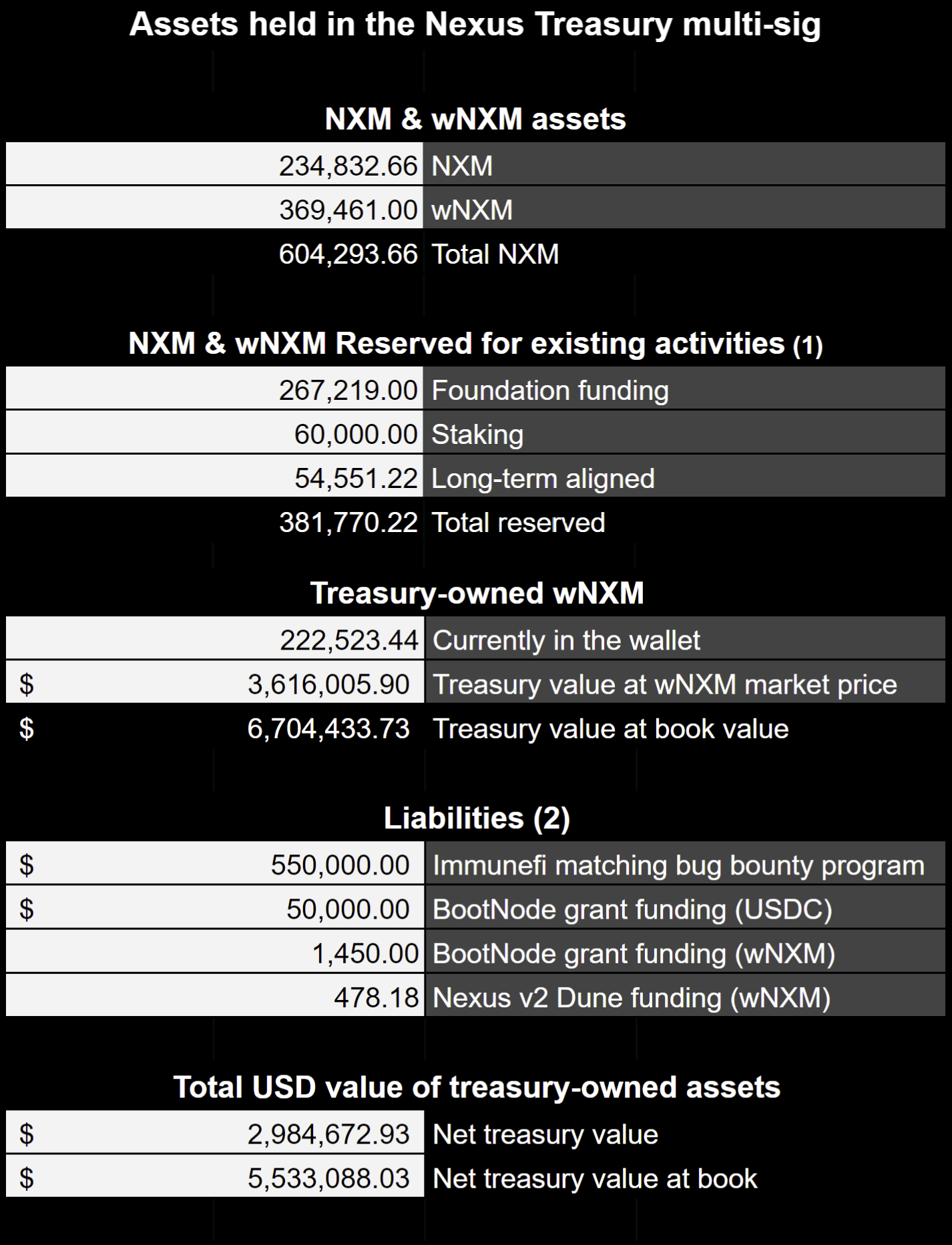

State of the Nexus Treasury and Expenditures Review

Members voted to allocate wNXM acquired through buyback in Dec 2021 and January 2022 in the following Snapshot vote.

Funding that is currently earmarked for programs, grants.

Reviewing treasury expenditures | Immunefi matching bug bounty program

The Immunefi matching bug bounty program has been active for over a year: it’s now time for members to review and evaluate whether or not the mutual should continue funding this program.

In this forum post, I review the cost of the Immunefi matching bug bounty program to date, the projected costs, and the impact on Nexus Treasury holdings.

Members should review, discuss, and decide if we should continue funding this matching program or if we should reduce or discontinue funding for the program.

Cost to date: 8,834 wNXM

Projected cost: $550,000 (32,797 wNXM at current wNXM price)

This proposal will be open for discussion and review until the 24th of October - on that day, it will be transitioned into a Snapshot vote. Members can share their thoughts, analysis, and comments on the forum.

Reviewing treasury expenditures | Dedaub smart contract monitoring service

The dedaub smart contract monitoring service has been active for over a year: it’s now time for members to review and evaluate whether or not the mutual should continue to provide funding for this service.

In this forum post, I review the cost of the dedaub smart contract monitoring service to date, the projected costs, and the impact on Nexus Treasury holdings.

Members should review, discuss, and decide if we should continue funding this smart contract monitoring service or if we should discontinue funding for this service.

Cost to date: 10,102.79 wNXM

Current cost: $20,000 per month (1,192.60 wNXM per month at current wNXM price)

This proposal will be open for discussion and review until the 24th of October - on that day, it will be transitioned into a Snapshot vote. Members can share their thoughts, analysis, and comments on the forum.

The Last Week in Review | 10-16 October 2022

Last Week in Cover Sales

In the last week, the mutual sold $30.3m USD worth of cover and earned $83.8k USD in fees, as outlined below.

We’ve seen consistent week-over-week growth in sales over the last several weeks!

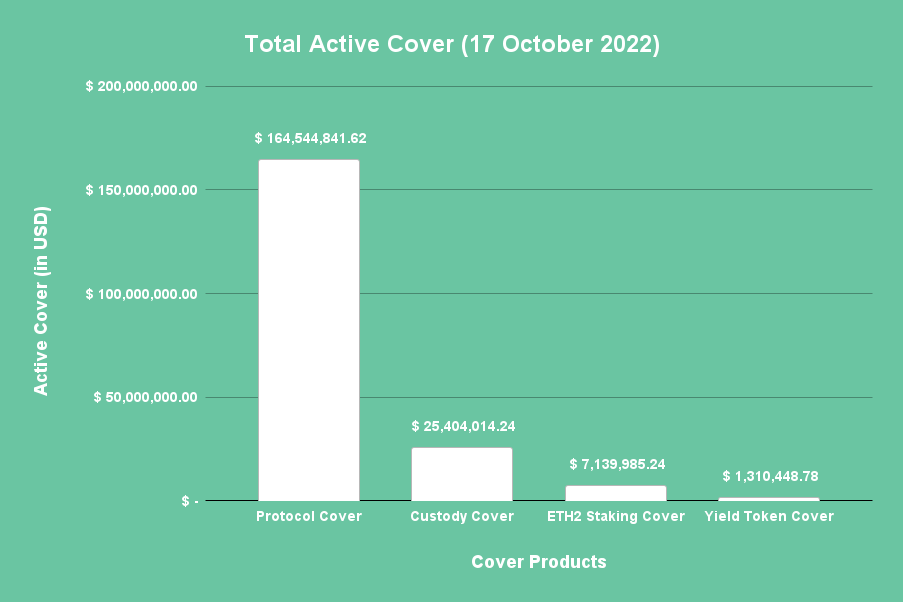

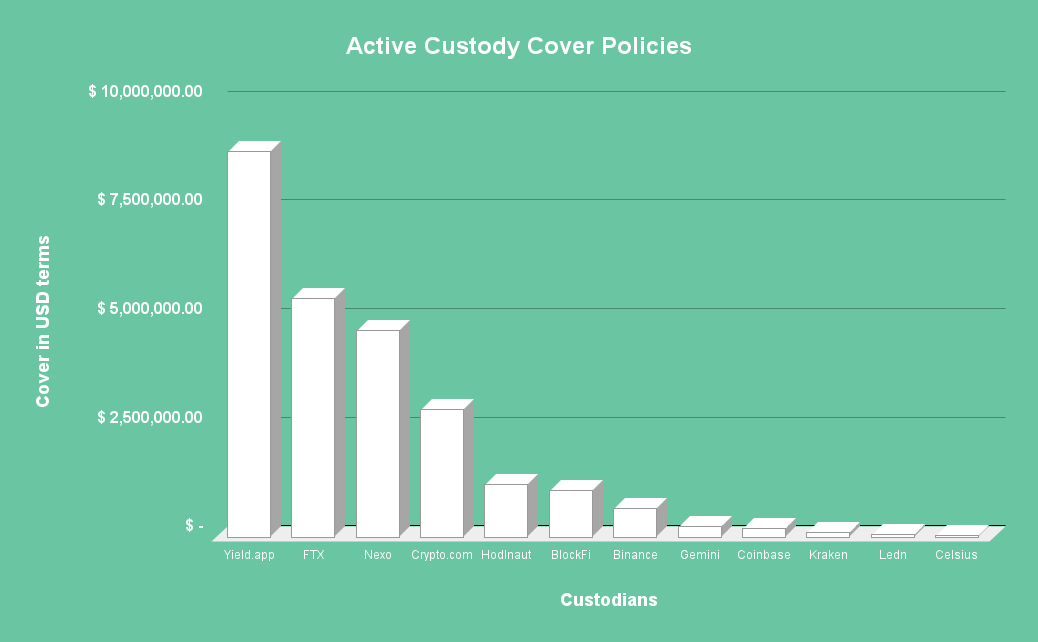

Active Cover as of 17 October 2022

Total active cover stands at $191m | 147,953.01 ETH with active coverage by cover type as follows.

You can review total active cover and active cover by platform on the Nexus Tracker platform.

Up Next

Join us on next week’s Mutant Meetup call in Discord at 9am EST / 1pm UTC to stay up-to-date on all things Nexus Mutual.

Don’t forget to follow the Nexus Mutual Twitter account for regular updates and communication from the mutual. You can follow the Nexus Mutual Bot Twitter account to stay up to date on cover buys as they happen.

Have a great rest of the week 🐢

Resources

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below.

Nexus Mutual’s community is most active on Discord. You may reach our team with any questions through LinkedIn and Discord.