This week, we celebrate a major milestone for Nexus Mutual 🎉

As you'll read below, members approved the Nexus Mutual V2 upgrade, which will allow the V2 updates to happen in stages, while allowing members to file claims.

Members have been active on the governance forum, as well! There are several important discussions happening, and we've summarized them below.

With a flurry of activity within the DAO, the newest iteration of the protocol approved for launch, and three major claim events coming in the next two weeks, we have some exciting updates for you this week.

Let's dive in.

DAO Highlights

Members vote to approve Nexus Mutual V2 upgrade

It's official–members have approved the V2 upgrades!

Now that this vote has been approved, the Nexus Mutual V2 upgrades can be implemented in stages, with partial claims functionality implemented as the first stage.

The remaining stages will be implemented after a reasonable window of time to allow for FTX, BlockFi, and Gemini Earn claims to be filed.

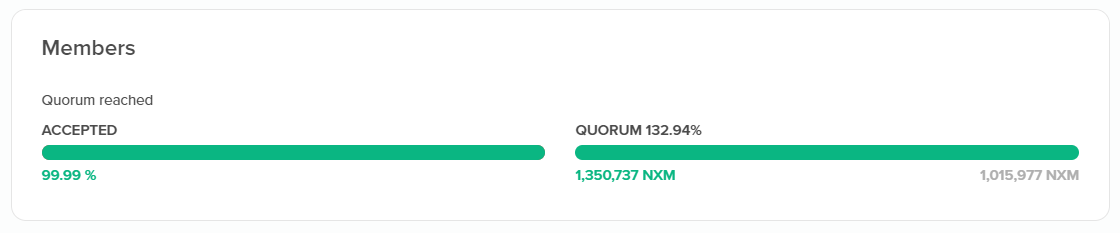

Voting turnout

Proposal 181 was open for voting between Monday (30 Jan) and Thursday (2 Feb) morning, at which time it was closed for voting with 1,350,737 NXM in voting weight cast.

Members approved the proposal with 99.99% voting in favor. The turnout for this vote surpassed quorum, with 132.95% quorum reached.

For more information, you can review the original proposal and the results of the on-chain vote.

Preparing for FTX International, FTX US, BlockFi, and Gemini Earn claim events

Over the next two weeks, members who held Custody Cover for these three custodians will be able to file claims according to the following schedule:

FTX International starting on Monday, 6 February 2023 at 10:54pm UTC

BlockFi starting on Thursday, 9 February 2023 at 1:16am UTC

FTX US starting on Thursday, 9 February 2023 at 5:00pm UTC

Gemini Earn starting on Tuesday, 14 February 2023 at 1:32pm UTC

Calculating losses for claims

The loss trigger for halted custodial withdrawals is the 90-day mark. Each claims spreadsheet will be updated with the crypto asset prices that can be used to determine loss amounts ahead of claims filing.

You can check the following spreadsheets for updates:

FTX International claims. The labeled tab will be updated with pricing information on 6 February 2023

FTX US claims. The labeled tab will be updated with pricing information on 8 February 2023

The labeled tab will be updated with pricing information on 8 February 2023

Gemini Earn Halted Withdrawals

The labeled tab will be updated with pricing information on 13 February 2023

Guides for claims filing

Members who plan to file claims can also refer to the FTX claims guide or the BlockFi and Gemini Earn claims guide.

If you need help, you can reach out on Discord in either the FTX Claims Support or BlockFi & Gemini Earn Claims Support channels.

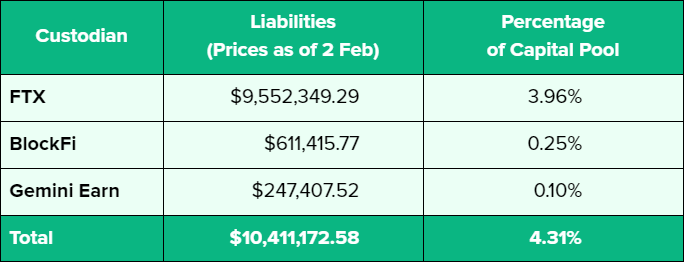

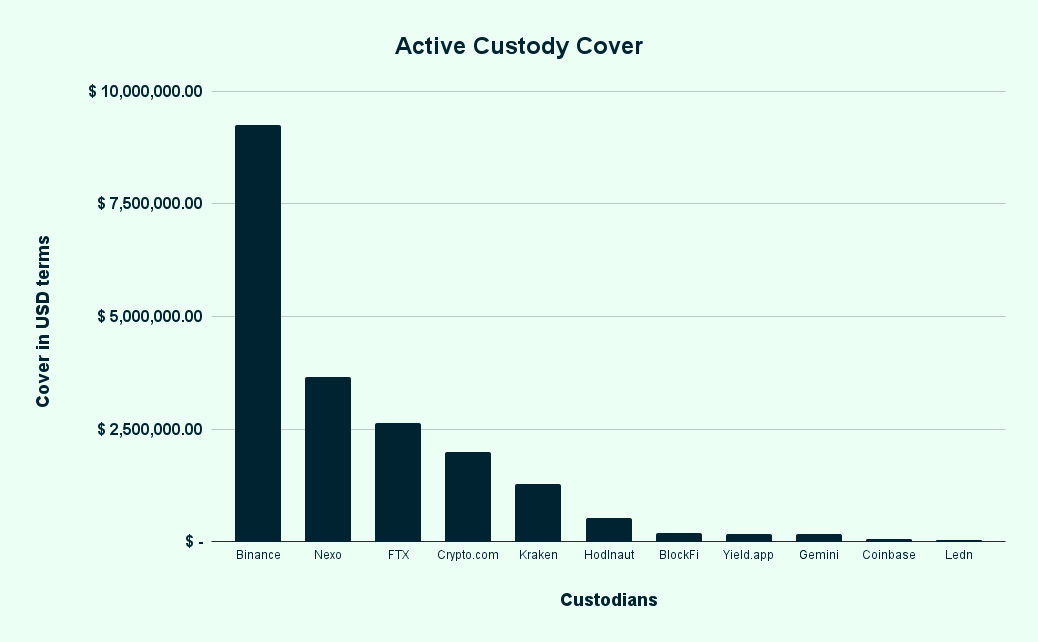

Current FTX, BlockFi, and Gemini Earn liabilities

You can review the current liabilities in detail in the spreadsheets above. Each spreadsheet breaks down the individual covers that can be filed for a claim if a loss has occurred. With partial claims functionality available for these claims, the actual claimed amounts may be less than total liabilities.

Total Upcoming Claim Liabilities

Claims Assessment

Members can participate in the claims assessment process by staking NXM, reviewing, and voting on the validity of Custody Cover claims as they are filed. For more information on the claims assessment process, read the entry in the Nexus Mutual docs.

You can review the mutual's claims history in the docs, as well.

Nexus Mutual is now on Lens!

If you’re on Lenster, you can follow the Nexus Mutual account 🌱

Our very first post received quite a few comments, mirrors, and likes! We’ll post more updates and share more information from our Lens account in addition to our Twitter account.

Follow us as we grow our presence on decentralized social media.

Governance Highlights

DAO Proposal: Q1 & Q2 2023 DAO teams budget request

There is less than one day left to participate in the DAO Snapshot vote for the DAO teams budget request for the next two quarters.

This vote has been open since Friday (27 January) and will close on Friday (3 February) at 2pm UTC.

The TL;DR

Total Request: $344,500 for 6-months

DAO Teams Renewing: Community, Marketing, and Investment

Newly Proposed DAO Teams: Operations and R&D

Funding Period: 1 February to 30 July 2023

The Q1 & Q2 2023 DAO team funding proposal consists of two posts:

Q1 & Q2 2023 | DAO Teams Budget Request Proposal. A high-level overview of each team, their purpose, how they align with the DAO values and mission, and the proposed team leads.

Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown. A deep dive into each team’s priorities, proposed team, and budget request. In addition, existing teams have provided a review of their Q3 & Q4 performance.

If you have any comments or questions, feel free to share on the forum or comment in the Nexus Mutual Discord.

Tokenomics Proposal: Replacing the Bonding Curve

Rei and the Tokenomics Working Group have been developing the newly proposed tokenomics model for the last two quarters. After considerable review by stakeholders and members within the Nexus Mutual community, Rei has brought a formal proposal to the forum to get feedback from members.

The proposal provides a high-level overview of the new tokenomics model, while linking to a more in-depth design paper.

The purpose of this post is to establish community consensus on the proposed tokenomics mechanism & begin a discussion on parameterisation.

This proposal is open for comments and all members should review and leave their thoughts and comments on the forum or participate in the discussion in the tokenomics revamp channel in the Nexus Mutual Discord.

wNXM buyback discussion

Members have been discussing the pros and cons of a potential buyback and how it would impact the Nexus Mutual V2 release and the tokenomics revamp project.

In the last week, members have been discussing the finer details of a proposal. The parameters being discussed:

Percentage of capital allocated to buybacks

Timeframe of execution

Price parameters

Technical requirements for execution

Engineering resources required

You can review and get involved in the discussion on the governance forum.

DAO Investment team discussions

In the last week, several discussions have started on the governance forum and Investment team members are requesting review and comments from members.

Members of the Investment team have started discussions on potential capital pool investment strategies and addressing the current asset liability mismatch.

Matching Currency of Assets and Exposure, posted by Rei

Investing the Capital Pool in Uniswap v3 ETH/DAI, posted by oSaaT

Treasuries and bonds, posted by Dopeee

These are all important discussions, which you can review and share your thoughts and comments. Going forward, you can expect more forum posts from members of the Investment team, as they engage in open, transparent discussions.

The Ease Risk Rubric for their Nexus Mutual V2 staking pool

Chris from the Ease team has shared the risk rubric they will use to assess which cover products they underwrite in their v2 staking pool, how they determine and price risk, and how they rate products based on this rubric.

It’s great to see one of the first staking pool managers providing members with a detailed review of their risk framework. You can review and share your thoughts and any feedback with the Ease team on the governance forum.

The Last Week in Review | 23–29 January 2023

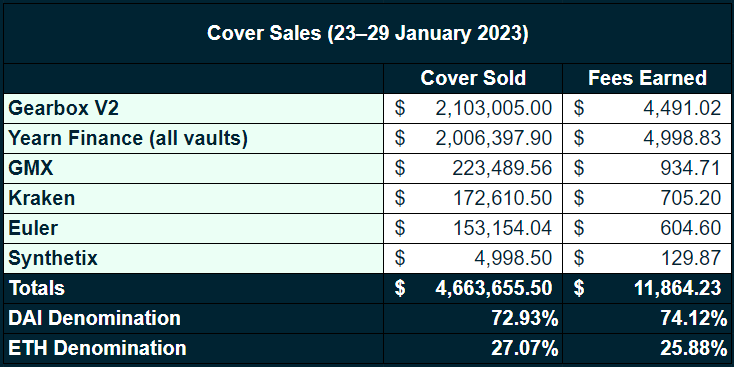

In the last week, the mutual sold $4.7m USD worth of cover and earned $11.9k USD in fees, as outlined below.

Active Cover as of 30 January 2023

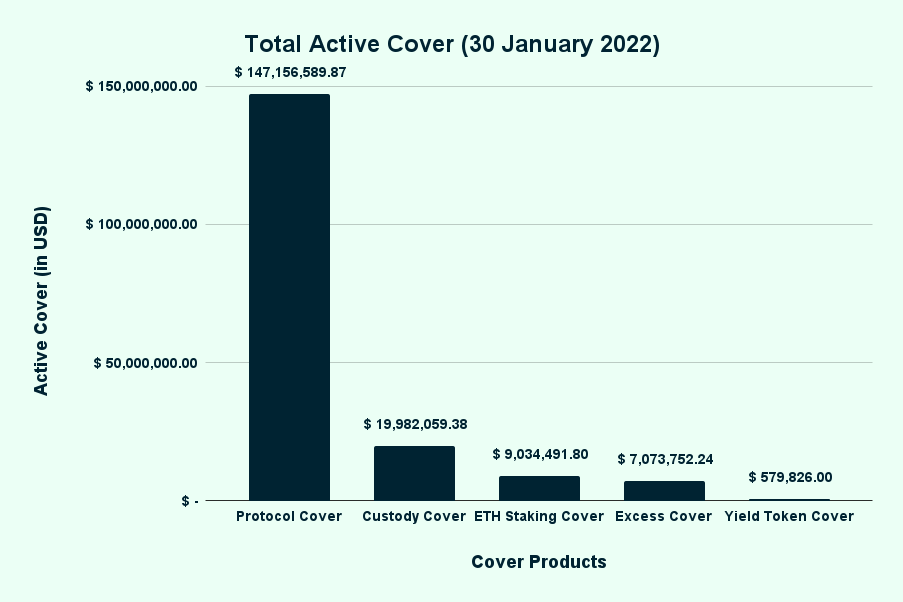

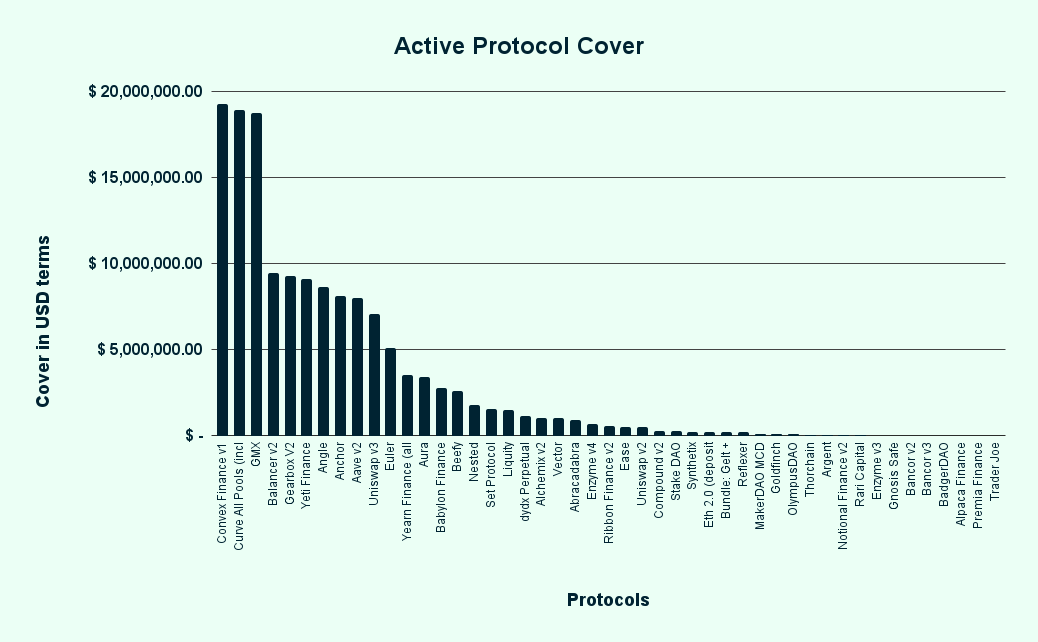

Total active cover stands at $183.8m | 116,630.22 ETH with active coverage by cover type as follows.

You can review total active cover and active cover by cover product on the Nexus Tracker.

Up Next

Join us on our next community call, which will be held on Tuesday (7 Feb) at 9am EST / 2pm UTC in the Nexus Mutual Discord!

Don’t forget to follow the Nexus Mutual Twitter account and Nexus Mutual Lens account for regular updates and communication from the mutual. You can follow the Nexus Mutual Bot Twitter account to stay up to date on cover buys as they happen.

Have a great week!

Resources

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below.

Nexus Mutual’s community is most active on Discord. You may reach our team with any questions through LinkedIn and Discord.