Welcome to the fifteenth edition of The Hedge!

In this issue, Hugh provides a status update for the new tokenomics project, and we share a guide for members who are interested in migrating their staked NXM from Nexus Mutual V1 to V2. You can also find a review of active discussions on the governance forum, the last week in cover sales, and more.

Let's jump right in.

Hugh’s new tokenomics update

On Wednesday, Hugh shared a new tokenomics progress update in the Tokenomics Revamp channel, which is included in full below.

The Nexus Mutual Foundation and DAO teams had an offsite in Lisbon last week, and we dedicated time to review the tokenomics changes members have signaled support for.

The goals of the workshop sessions were to:

Understand the mechanics in detail

Identify any big technical challenges that might require revisiting the business requirements documentation and/or proposed design put together by Rei

Identify any areas of concern from an edge case and/or attack perspective

Discuss the need for a TWAP and brainstorm potential solutions (biggest gap in the current business requirements)

I'm pleased to say the workshops went really well. During our discussions, we didn't run into any obvious technical issues. The team did discuss one potential attack scenario, where oracle manipulation could take place on the TWAP, so this will be top of mind while reviewing solutions. The team has identified several potential solutions, which will be further researched, reviewed, and discussed. Worth noting that finding a solution is more of an optimisation issue than any big research work to be concerned about.

After the offsite, the next step is for the engineering team to draft the detailed technical specifications. The Foundation is planning to dedicate some of our engineering team to focus solely (as much as possible) on the tokenomics project. This will ensure we continue to make progress even when the inevitable urgent distractions appear.

I cannot provide a firm timeframe for the tokenomics project like many have requested. Security is our first priority, and we will provide regular status updates and keep members informed of next steps.

The Community team will keep members up to date as future updates are shared. To learn more about the new tokenomics project, read the summary in the documentation.

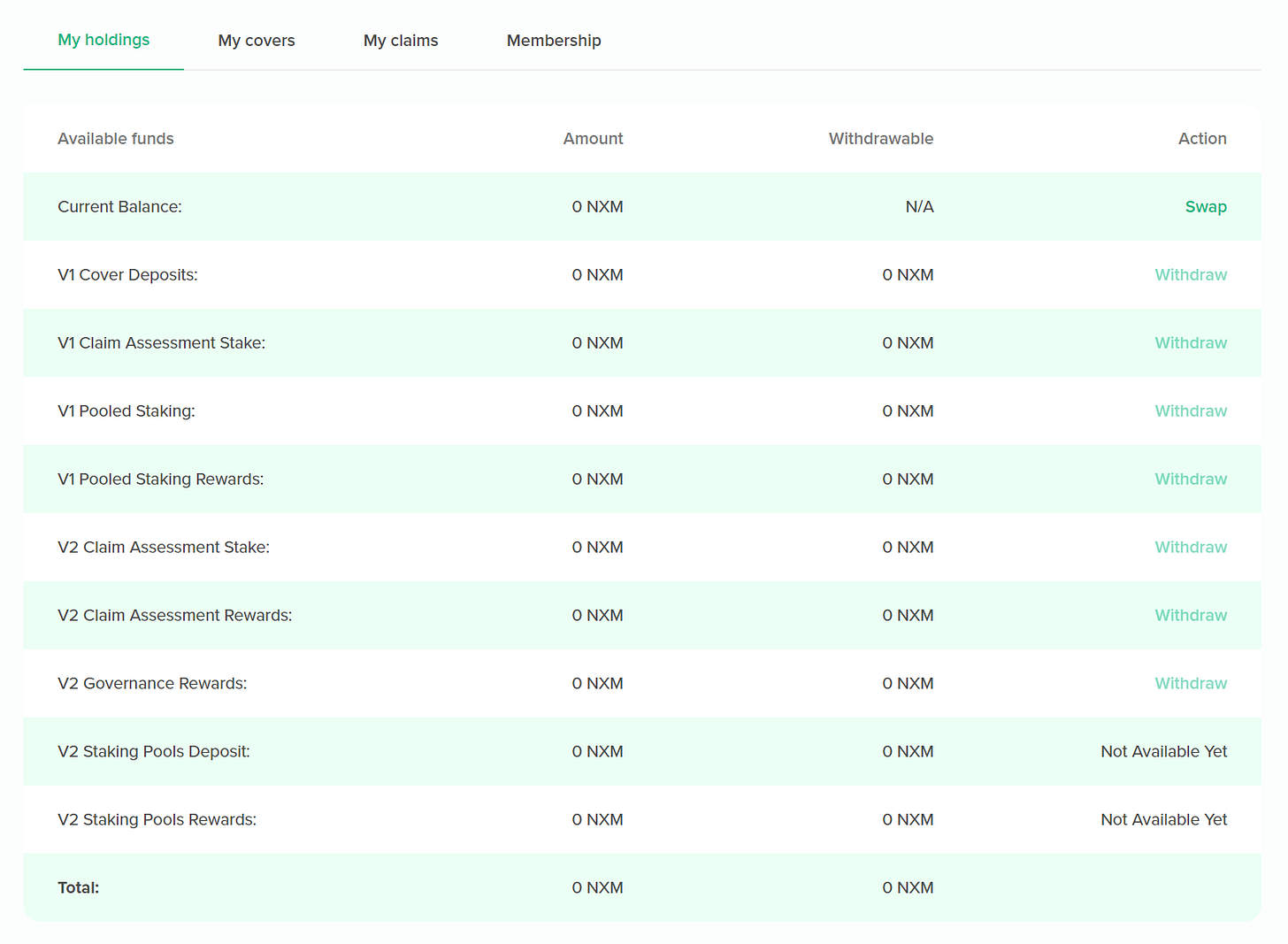

Migrating staked NXM from V1 to V2

If you had NXM staked in the protocol before Nexus Mutual V2 launched, your NXM can be withdrawn from the V1 smart contracts. You can see any NXM still held in the V1 smart contracts in the Nexus Mutual UI once you connect your wallet.

Go to the Membership page. By default, you will see the My Holdings screen. On this screen, you will see any NXM held as a cover deposit or in the claims assessment or pool staking contracts, as well as any pending rewards in V1 that may be claimed.

Under the Action column, you will see the option to Withdraw your NXM balance from any of the V1 contracts, should you still have NXM staked or rewards pending.

After you withdraw your NXM from the V1 smart contracts, you can explore the different ways you can use NXM to participate within the mutual since the launch of Nexus Mutual V2 in March.

Since the launch of V2, there have been nine staking pools created, with over 250,000 NXM being staked across them. In V2, members have the option to create their own staking pool or delegate their staked NXM to an existing pool. With these two options, you can stake your NXM, socialize gas costs, and earn rewards passively or take an active role in managing your NXM by launching a staking pool.

Check out Nexus Mutual's documentation to learn more about staking and explore the current staking pools in the Nexus Mutual UI.

WeFi and Exactly Protocol Cover listings

Last week, we shared that Nexus Mutual now offers Protocol Cover for Exactly Protocol and WeFi.

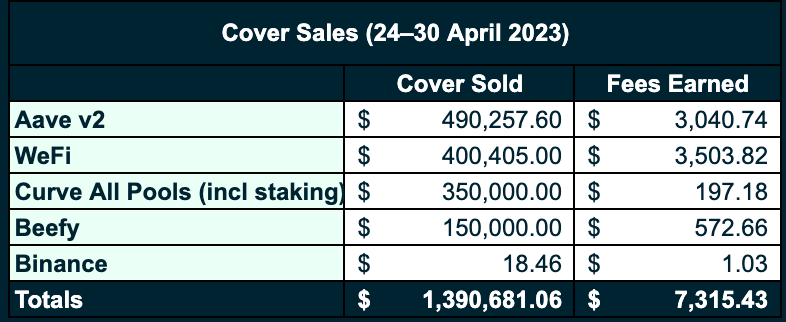

Since our last newsletter, members have purchased cover for $400,405.00 from WeFi alone. This shows the high level of interest and demand for Nexus Mutual's Protocol Cover offerings.

Currently, there is:

521.6k DAI in open capcity for WeFi Protocol Cover

133.4k DAI in open capacity for Exactly Protocol Cover

In case you missed it, Exactly Protocol is a decentralized credit market solution for exchanging the time value of assets, and WeFi is a decentralized money market protocol on Polygon that offers investment loan options in DeFi.

Explore the Exactly Protocol Cover and WeFi Protocol Cover listings in the Nexus Mutual UI.

Also, be on the lookout for more listings in the future!

➡️ If you are a protocol team interested in requesting a listing, please use the Nexus Mutual contact form to get in touch.

Governance forum discussions

Nexus Mutual members continue to actively discuss several proposals on the governance forum. You can review and get involved in the following discussions:

Nexus Mutual members have been discussing a proposal by the Avantgarde Treasury team to redeploy funds from the Enzyme vault. The team has responded to various questions from the community. They clarified their role in the proposed investment and shared insight on their management and monitoring approach. This includes diversification based on each staking provider’s track record, geography, and operational setup, as well as monitoring risk elements such as regulatory events, security alerts, governance proposals, and more. The Avantgarde team plans to work on a formal protocol improvement proposal based on community feedback.

Uisce.eth proposed that Nexus Mutual allocate around 10% of the capital pool to stake with Rocket Pool. rETH is the third largest ETH liquid staking token by TVL, following Lido's stETH and Coinbase's cbETH. The RFC is detailed, including a review of the rationale for the investment, the proposed amount, the oracle solution and liquidity available for rETH, potential risks, security of the protocol, and more.

Jeremiah, one of the co-founders at OpenCover, requested feedback on the Blue Chip Protocol Staking Pool they have launched in partnership with DeFiSafety.

Tetiana introduced DAOsign, a contract management system for DAOs.

Review, comment, and get involved in the Nexus Mutual governance process!

The Last Week in Review | 24–30 April 2023

In the last week, the mutual sold $1.4m USD worth of cover and earned $7.3k USD in fees, as outlined below.

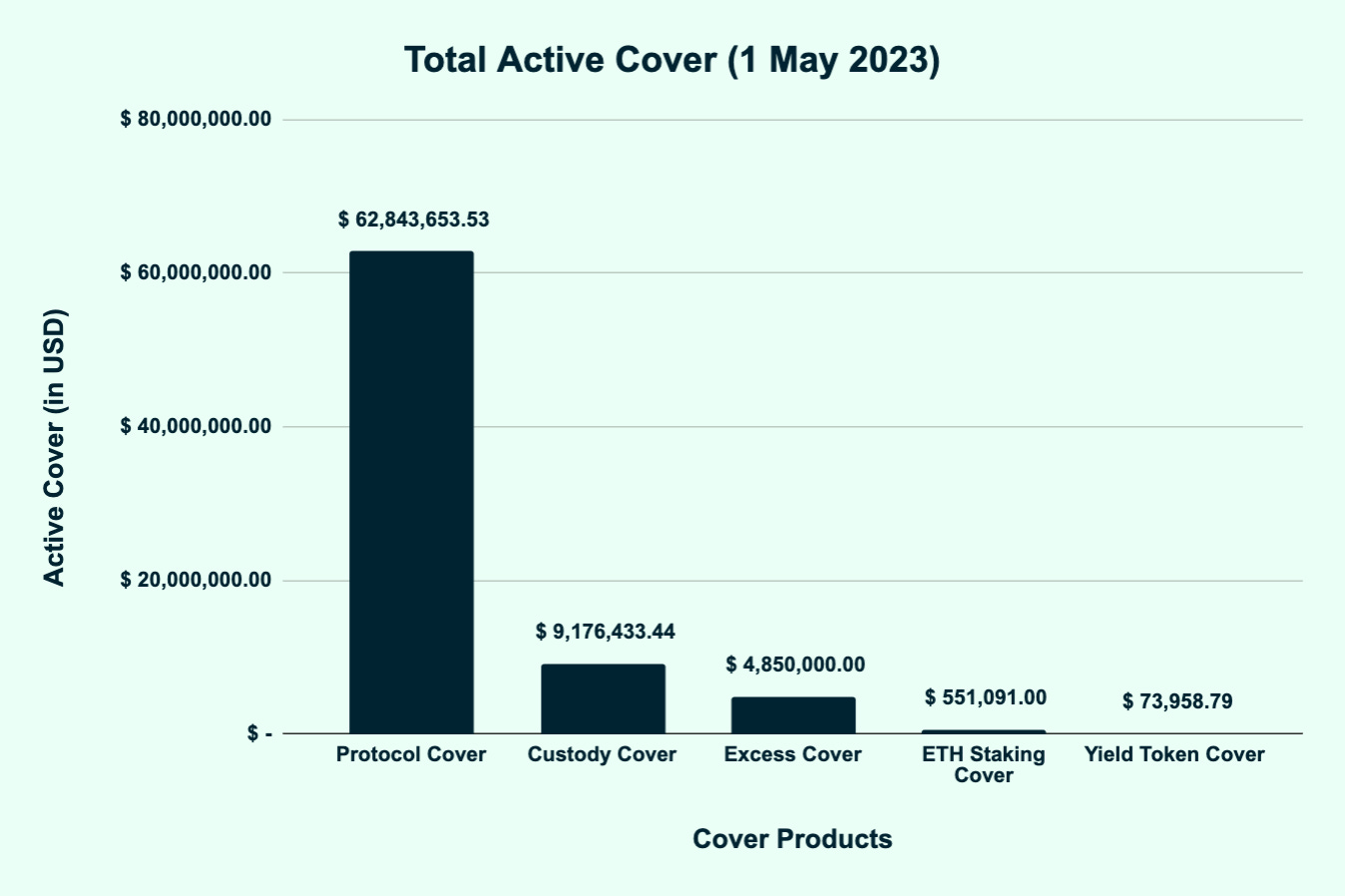

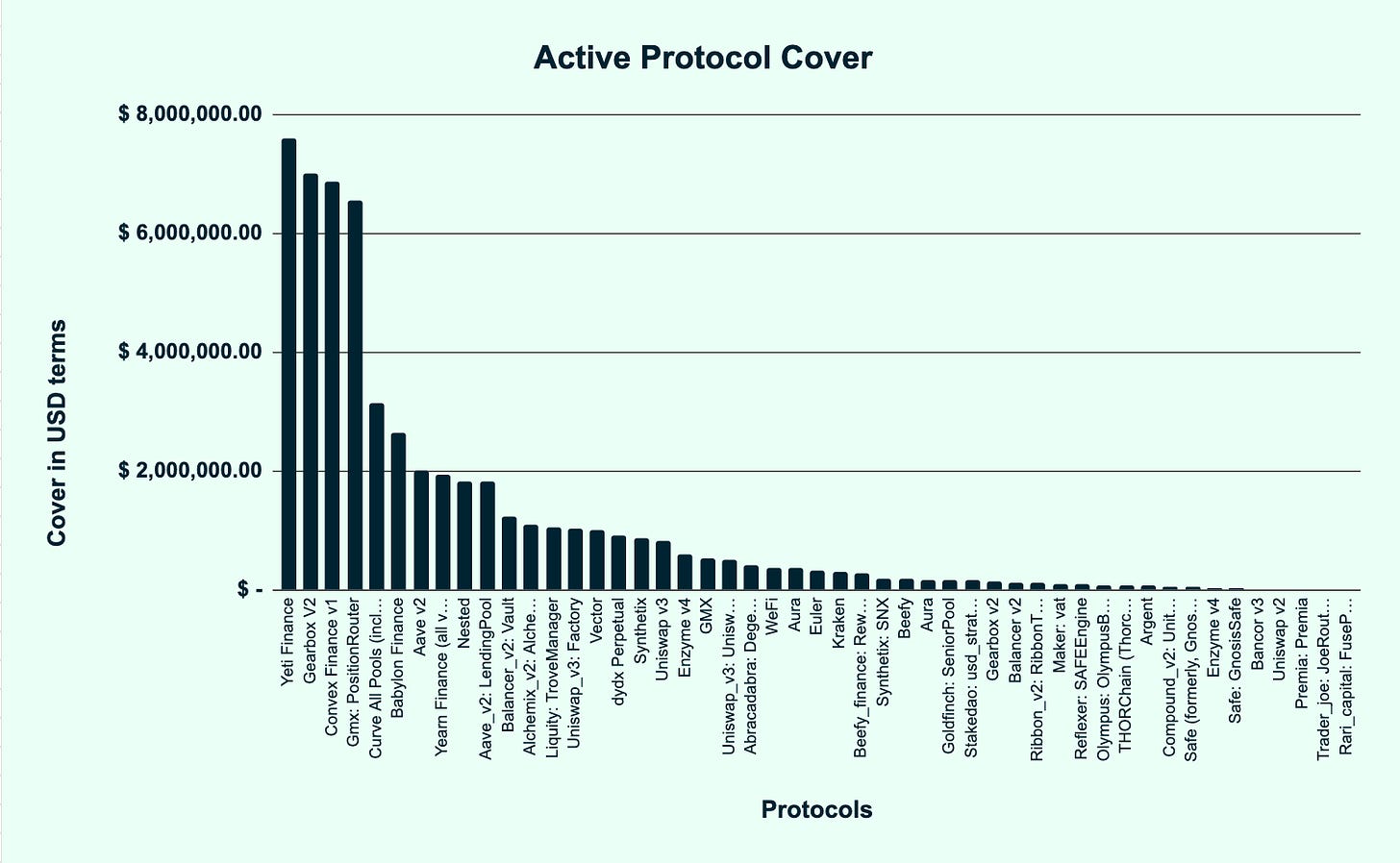

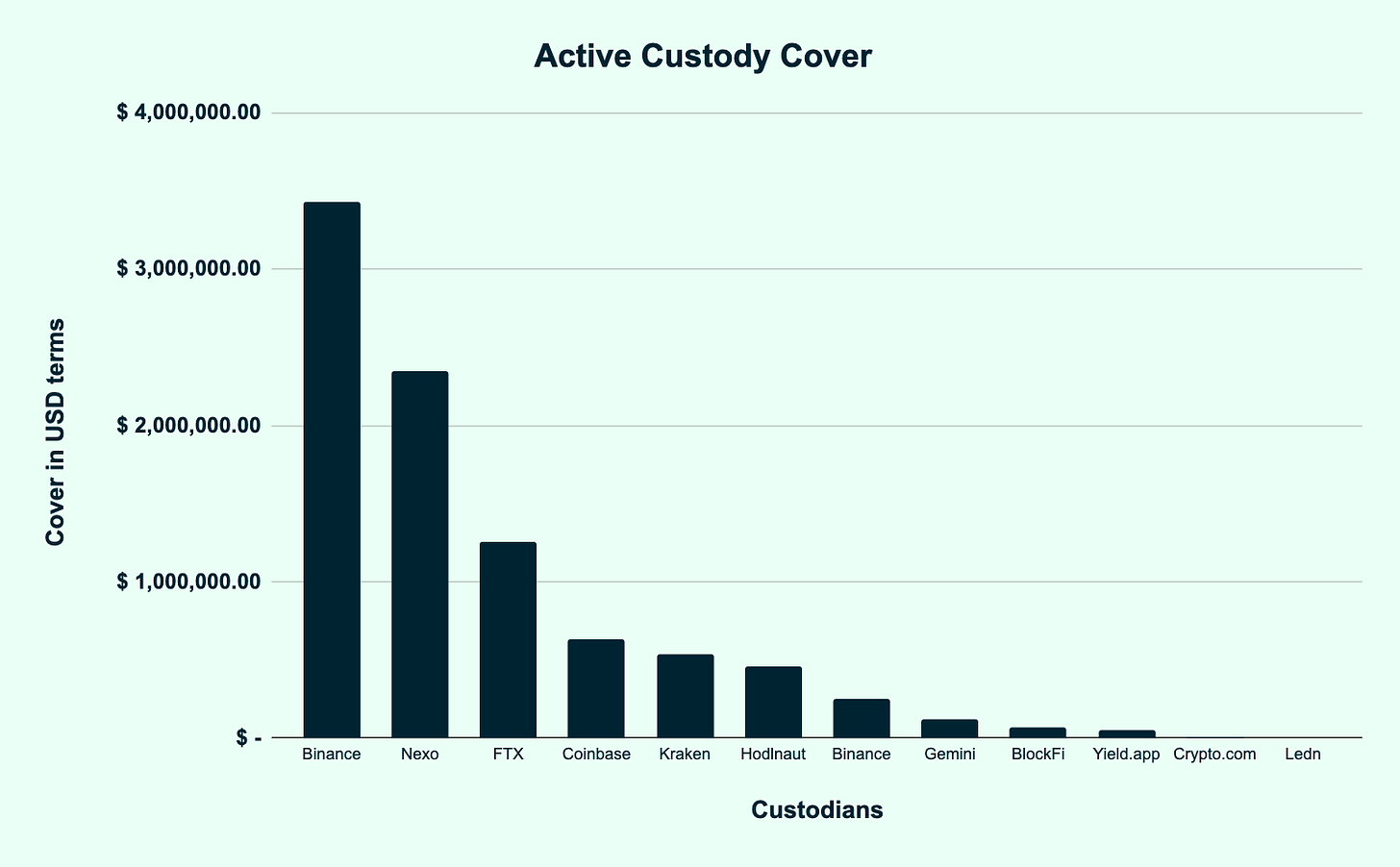

Active Cover as of 1 May 2023

Total active cover stands at $77.5m with active coverage by cover type as follows.

Up Next

Don’t forget to follow the Nexus Mutual Twitter account and Nexus Mutual Lens account for regular updates and announcements from the mutual.

Join us for our next community call on Tuesday (9 May) in the Nexus Mutual Discord! We’ll share the latest updates and provide an open forum for members.

Have a great week!

Resources

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below.

Nexus Mutual Dune Dashboard for Capital Pool and Ownership, created by Nexus Mutual R&D and Marketing teams

Nexus Mutual Dune Dashboard for Claims, created by Nexus Mutual R&D and Marketing teams

Nexus Mutual Dune Dashboard, created by Richard Chen

Nexus Mutual’s community is most active on Discord. You may reach our team with any questions through LinkedIn and Discord.