In 2023, Nexus Mutual members were busy building an innovative risk-sharing ecosystem:

🤝 Through our partnership with the Retail Mutual, Nexus Mutual begin underwriting real-world risks for the first time. Our members are helping to protect more than 5,000 UK small businesses against risks such as fire, theft, and accidental damage.

🔢 With the Tokenomics Upgrade, Nexus Mutual members voted to upgrade the NXM token model and replace the Bonding Curve with the Ratcheting AMM (RAMM) mechanism. The MCR Floor was also removed, which gave members greater flexibility to mint and redeem NXM.

🗳️ Last month, members approved a retrocession and investment agreement with Cover Re. This will expand the Mutual’s real-world underwriting portfolio.

As we embark on 2024, we are excited to highlight our teams’ updated priorities, which are outlined below.

Nexus Mutual’s Core Objectives

Our core objectives for Q1 & Q2 2024:

Growth: This remains our top priority. The Foundation and DAO teams initiatives look to increase cover sales, expand product offerings, and onboard new members within the Nexus Mutual ecosystem.

Tokenomics: Now that Stage 1 of the tokenomics revamp project has launched, the Engineering and R&D teams will begin work on Stage 2 of the project to ensure sustainable growth can be achieved in high and low capitalisation scenarios.

Progressive Decentralisation: Our journey towards decentralisation is ongoing. In the next six months, the Foundation and DAO teams will be researching ways to drive member engagement in DAO initiatives and involve more members in team-led initiatives to achieve growth while maintaining our decentralised ethos.

Team Priorities

Each team within Nexus Mutual plays a vital role within the Mutual:

The Engineering team members are tasked with the technical work necessary for the Nexus Mutual protocol to offer new cover products, starting with the technical requirements for the Cover Re agreement. The team will work to enhance the product experience through the launch of cover edits and UI/UX enhancements. Engineering will also research how to further reduce gas costs and how account abstraction can be incorporated into the Nexus Mutual user interface.

The Business Development team will work to increase cover sales with crypto native and traditional deals, which can include partnerships with DeFi teams and TradFi institutions. They are focusing on more deals in traditional markets to establish the Mutual as a reliable partner in alternative risk transfer.

Our Legal team is focused on supporting new product developments, which includes finalising deal terms for the Cover Re deal. Legal also continues to pursue reimbursement to the Capital Pool per the mandate in NMPIP-205.

Product & Risk will contribute to the cover product development process and support the Mutual’s growth objective. They will also support the account abstraction research project and evaluate potential options for a membership benefits programme.

At Research and Development (R&D), the team’s main focus will be on Stage 2 of the tokenomics revamp project, particularly defining how liquidity is managed when the Capital Pool balance is close to the cover-driven Minimum Capital Requirement.

The Community team is dedicated to enhancing the members’ experience through various initiatives, such as updating portfolio management sites with the Nexus Mutual V2 contracts, creating governance resources, and researching ways to allow more members to participate within the DAO. Community will launch an interview series on Discord and X (formerly Twitter) to create awareness about the Mutual and increase community engagement.

To learn more about each teams’ priorities, review the Q3 & Q4 2023 highlights in the Nexus Mutual Roadmap | Q1 & Q2 2024 post on the governance forum.

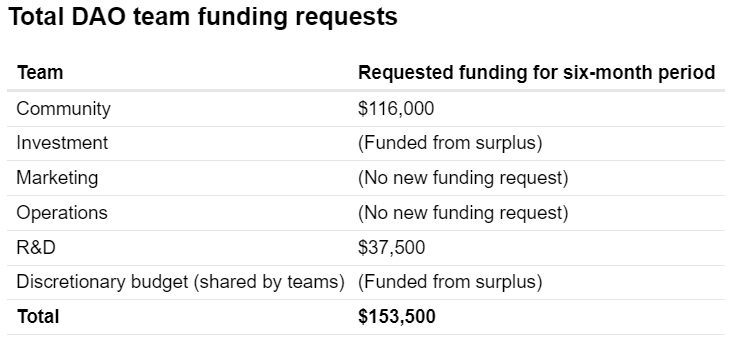

DAO Teams’ Funding Proposal for 2024 Q1 and Q2

The Nexus Mutual DAO teams are asking members to review their Q1 & Q2 2024 funding request, so they can continue working on behalf of members to drive adoption and awareness.

Review Timeline

The RFC proposal will be open for review and comment from 8–21 January.

If no substantial comments are received, this funding proposal will transition to a Nexus Mutual DAO Proposal (NMDP), which will open for comment from 22–29 January.

After 29 January, the NMDP proposal will transition to a Snapshot vote, which will open on 30 January and will close on 5 February.

We eagerly await comments and feedback from the community!

Ecosystem Highlights and Resources

We are proud of our ecosystem partnerships that allow the Mutual to expand cover and protect more users across markets.

OpenCover's Launch on Layer 2 Networks: OpenCover launched on Base, Optimism, and Arbitrum, making coverage more accessible and cost-effective for users across L2s.

Unity Cover's Innovations in DeFi and TradFi: Unity Cover collaborated with institutions and teams across DeFi and TradFi to offer new cover products throughout 2023. Most notably, Unity Cover’s partnership with The Retail Mutual enabled members to underwrite real-world risk for the first time in the Mutual’s history. Members voted to approve Unity’s NMPIP-212 proposal to enter into an retrocession agreement with Cover Re to build further momentum toward future real world deals they’re pursuing in 2024.

UnoRe's WatchDog Protocol for Code Security: UnoRe's WatchDog provides auditing and threat detection services to DeFi teams, ensuring their code is secure for production, with further insights available in Staking Pool 18. They launched their staking pool and began purchasing cover in August 2023.

Valuable Resources

The Nexus Mutual Roadmap | Q1 & Q2 2024 on the governance forum details our teams’ objectives and priorities for the next six months.

The Q3 Insights Report offers a comprehensive view of the Mutual’s performance, partnerships, market trends, and member activities. Keep an eye out for the Q4 Insights report, which will be posted on the forum later this month.

Tokenomics Update. Following the Ratcheting AMM’s (RAMM) launch on 21 November, members were able to redeem NXM for ETH in the Nexus Mutual UI during the fast ratchet period. With NMPIP-209, members approved an initial budget of 43,835 ETH for the fast ratchet period. The fast ratchet period ended on 25 December after members redeemed the full initial budget amount and the RAMM transitioned to its long-term state parameters, which you can review in the Nexus Mutual documentation.

To date, more than 2.1m NXM have been redeemed for ~45k ETH.

For an overview of redemption activity during the fast ratchet period, you can refer to the Nexus Mutual Ratcheting AMM Dune dashboard created by the DAO R&D team, the NXM Dune dashboard created by Richard Chen, and the redemption analysis below.

Thank You!

As we step into 2024, Nexus Mutual is more committed than ever to fostering a revolutionary ecosystem where anyone can protect anyone else through shared risk. Discover how our teams are planning to continue advancing our objectives by exploring our latest proposal, Q1 & Q2 2024 DAO Teams Budget Request, available on our forum.

We thank you for your support and look forward to another groundbreaking year where Nexus Mutual continues to serve as a key example of how blockchain technologies can provide a real collective benefit.

Resources

You can find the January updates from the Nexus Mutual community below:

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below:

Thanks for reading!

We look forward to seeing you at our next Community Call on the Nexus Mutual Discord on 30 January (Tuesday) at 1pm UTC!