We hope you had a great Thanksgiving and maybe even found time to talk about the recent crypto market surge with friends and family!

As a holiday treat, we’ve packed this issue with updates, including a recap of Nexus Mutual’s latest partnerships. Collaborations with Native and Ensuro are expanding opportunities for our members to underwrite real-world risks.

Plus, we’ve gathered some exciting highlights from the community. Let’s dive in!

Calls to Action 🗳️

Review the new Dune dashboards

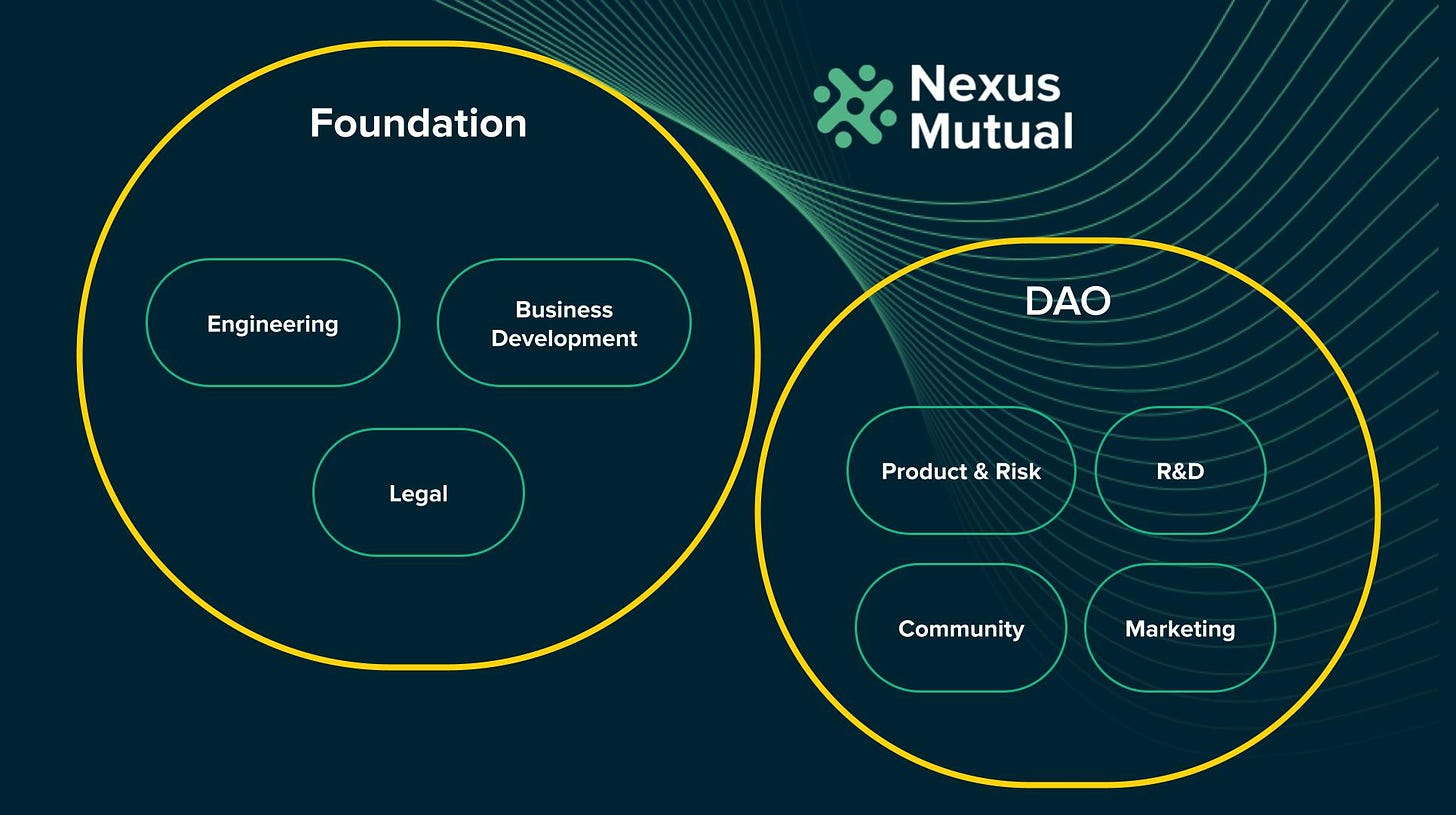

The DAO teams lead transparency efforts within Nexus Mutual. With our R&D and Community teams, we’ve developed a new dashboard to replace basic weekly sales reports and deliver real-time analytics across various time intervals.

The Community Dashboard simplifies access to data, offering easy-to-generate weekly, monthly, and quarterly analyses—ideal for members and enthusiasts with limited experience using Dune Analytics tools.

📊 Take a look at the new Community Dune Dashboard.

🐢🐢🐢

Join the next cohort of the DeFi & Risk Learning Group

The DAO Community team’s Governance Reading Group has grown into a vibrant space for exploring governance paradigms through technology, cooperativism, and accessibility. Now, we’re bringing this collaborative learning approach to DeFi enthusiasts who are captivated by the evolving financial mechanisms on Ethereum. Learn more about the Governance Reading Group on the DAO Website.

🥁 Announcing our new DeFi Risk Learning Group for the new year!

Every two weeks, we’ll explore new materials, analyze protocols, and share insights online. Whether you’re a DeFi novice, a seasoned participant, or simply eager to connect with others active in the space, this group is for you.

Together with members, we’ll co-create a reading and discussion curriculum. Here’s a preliminary and flexible outline:

DeFi Basics

What is decentralized finance all about?

Interacting with DeFi: UX, wallets, dashboards.

What are smart contracts?

High-level overviews of different sectors in DeFi

Lending

DEXes

Derivatives

Payments

Assets

NFTs

Stablecoins

Layer 2

Diving into key concepts

Liquidity Pools

Impermanent Loss

Yield Farming

Different cycles, changing narratives

Recent discussions

Risks in DeFi

What are the types of risks in DeFi?

Deep dive into common risk types and attack vectors

Smart contract hacks

Oracle failure/manipulation

Severe liquidation failure

Governance attacks

📄 If you’re interested, fill out this short form and we’ll be in touch with more details soon!

🐢🐢🐢

Share your experience with Nexus Mutual anonymously!

At Nexus Mutual, every decision we make is driven by our commitment to make DeFi safer. Over the years, we’ve helped pay out more than $18 million in claims, providing support to our members when they needed it most. From covering exploits and smart contract failures to offering peace of mind in a fast-moving space, Nexus Mutual has you covered.

Now, we want to hear your thoughts. Have you used Nexus Mutual cover before? Or are you currently protected?

Take our quick 3-question survey to share your experience. It’s anonymous, takes less than a minute, and helps us continue refining the protection that keeps DeFi thriving.

🐢🐢🐢

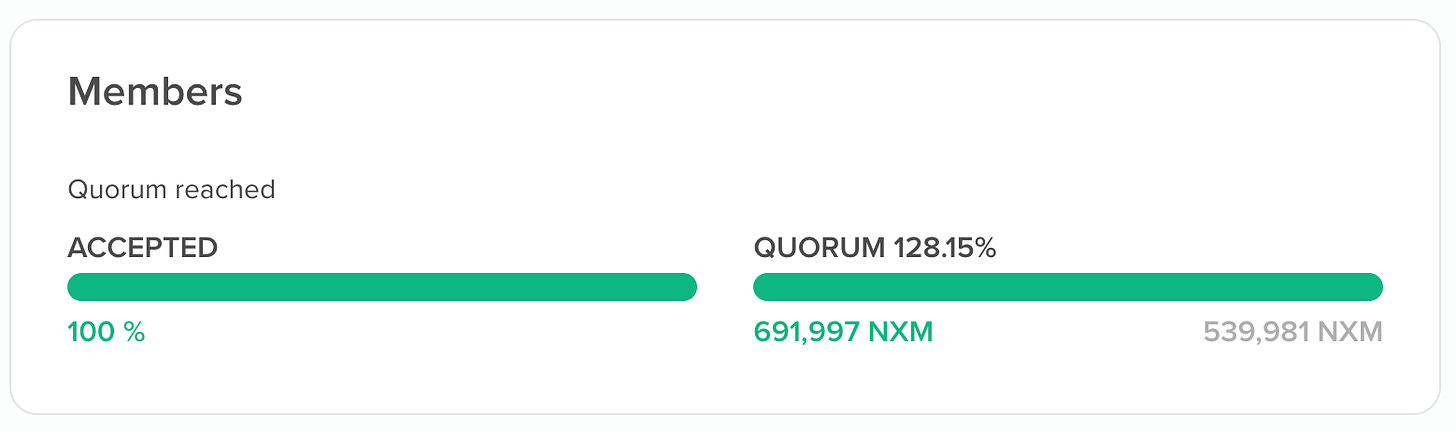

Vote on NMPIP 243: Protocol Pricing Parameter Adjustments, Features

The Product & Risk team is proposing adjustments to pricing parameters and the introduction of fixed-price public listing functionality to support growth and improve the user experience.

One key proposal is reducing the PRICE_BUMP_RATIO from 20 to 5 to allow for more gradual price increases after cover buys. This change should help make cover prices more affordable and consistent, encouraging buyers to transact without delays caused by sudden spikes.

Additionally, the removal of Surge Pricing simplifies the pricing structure. This should lead to improved cover sales and a better overall experience for both cover buyers and stakers.

Another important adjustment involves changing the Global Min Price to the Default Min Price, set at 1%, while introducing a Listing_Min_Price for tailored minimum pricing. This flexibility allows competitive pricing for specific products, such as ETH Slashing or other targeted offerings, while maintaining safeguards against underpricing.

Finally, the introduction of fixed-price public listings, underwritten by any staking pool manager, ensures broader accessibility and prevents pricing races to the bottom for fixed-price public listings.

Together, these updates simplify pricing, enhance the cover buying experience, and strengthen the Mutual’s competitive position across its product lines.

The proposal was open for review over the past 14 days and has just moved to an onchain vote on Tuesday, 3 December. If approved, the Advisory Board will implement these changes as they become ready.

Recent Highlights 🔎

Nexus Mutual Partners with Native to Expand Distribution

Native, a leading insurance broker, recently secured $2.6 million in seed funding led by Nexus Mutual. This investment aims to accelerate Native’s mission to expand insurance capacity for the crypto industry and beyond.

Native will provide $20 million in onchain cover per risk, supported by Nexus Mutual’s Capital Pool. This collaboration expands Nexus Mutual's decentralized insurance capabilities while enabling Native to underwrite more risk. Native not only connects businesses to Nexus Mutual’s risk-sharing capital but also facilitates crypto-native payment and claim settlement processes.

👉 Read more on CoinDesk: DeFi Cover Provider Nexus Mutual Backs New Crypto Insurance Broker Native

🚀🚀🚀

Nexus Mutual x Ensuro: Bringing Onchain Capital to Real-World Insurance

Nexus Mutual has partnered with Ensuro, a blockchain-based reinsurer, to enable risk transfer between onchain capital and real-world insurance markets—a significant step in integrating DeFi into broader financial systems.

By connecting Nexus Mutual stakers with real-world insurance policies, Ensuro unlocks opportunities for new types of risk transfer powered by the Nexus Mutual protocol.

Together, we’re proud to expand coverage to risks often overlooked by conventional insurance.

👓 Learn more on the Nexus Mutual Blog: Nexus Mutual and Ensuro Partner to Connect Onchain Capital with Real-World Risk

🚀🚀🚀

Introducing Bitcoin-Denominated Cover: Secure Your BTC Onchain

With Bitcoin reaching new milestones, Nexus Mutual is proud to launch the world’s first Bitcoin-denominated cover.

Using cbBTC, the Mutual now has the ability to offer Bitcoin-denominated cover across a range of protocols on Base through the Base DeFi Pass. Whether you’re depositing BTC on Aave, Aerodrome, Ether.fi, Euler, Morpho, Lombard Finance, or other protocols, you can now safeguard your Bitcoin with ease.

🛡️ Ready to protect your BTC? Visit the Nexus Mutual UI!

🚀🚀🚀

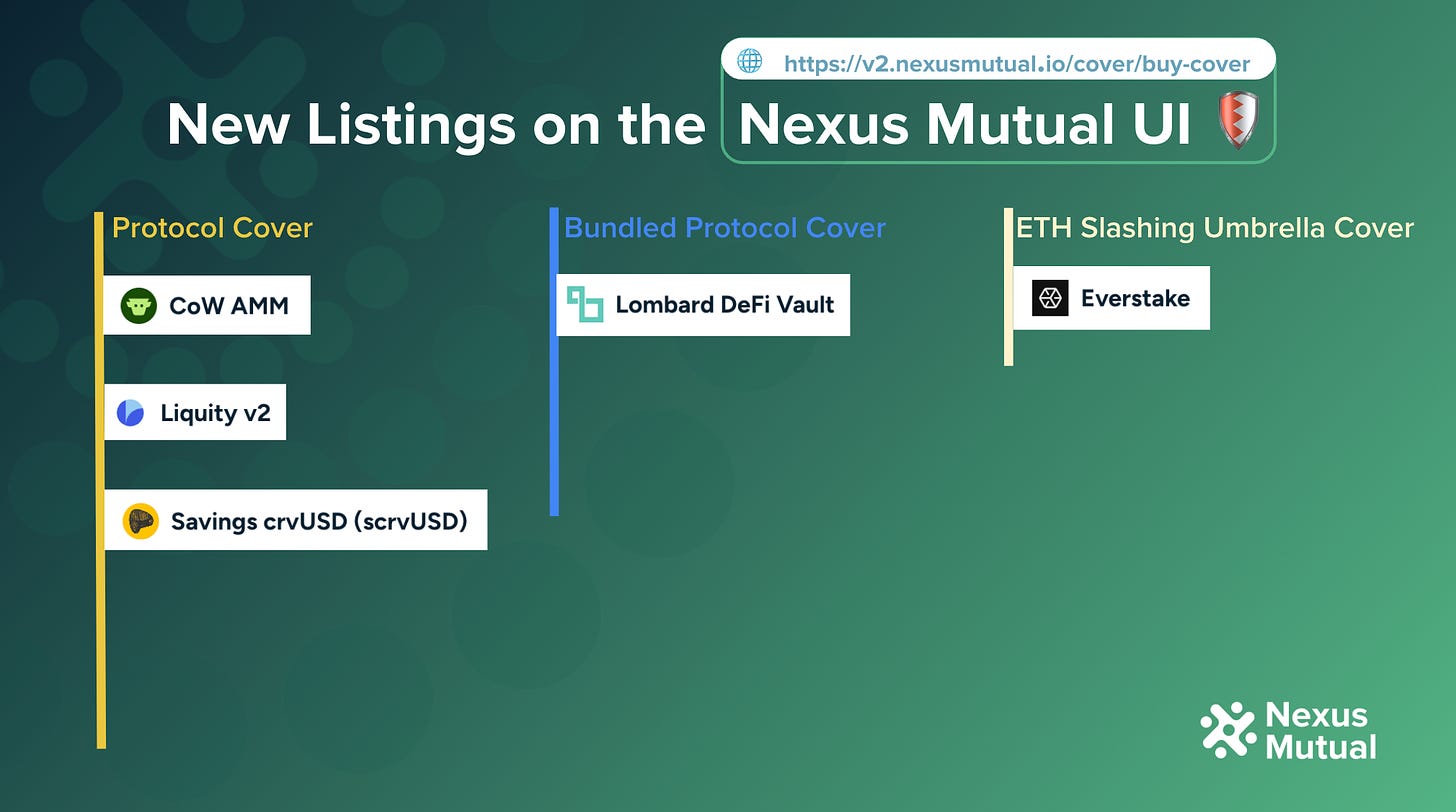

New Listings on the Nexus Mutual UI (Mainnet) and on OpenCover (L2)

The Community Bulletin 📌

Tomasz’ Notes from DevCon. Tomasz from the Nexus Mutual DAO R&D Team was at Devcon in Bangkok last month. Some of his favorite talks? OpSec for the Dark Forest, The Next Generation of Decentralized Governance, DAOs Unmasked: The Hard Truths Behind the Hype, Exploring the Future of Account Abstraction and Ethereum a Force of Good.

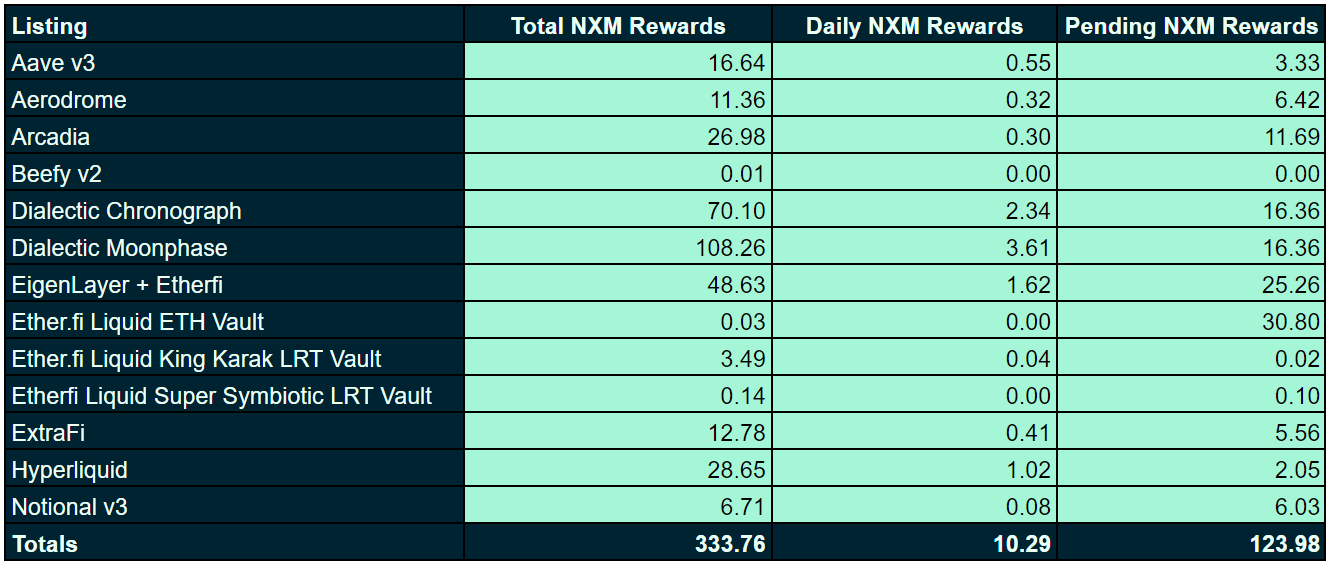

Investment Committee Newsletter | November 2024. The Investment Committee shared its November update, highlighting key insights on the Capital Pool and Nexus Mutual’s investments. Last month, the Mutual earned a total of 128.4 ETH from its investments. For detailed insights, check out the forum post.

DeFi Pulse Bi-Weekly. We’ve revamped our bi-weekly community calls on X Spaces! Going forward, these calls will spotlight the State of DeFi, presented by BraveNewDeFi, Nexus Mutual DAO’s Head of Product & Risk. You’ll also hear Foundation Team updates from Hugh and engaging community insights from Sem. Don’t miss out—subscribe to the Community calendar here.

Whitepaper’s 7th Anniversary. On November 1st, we celebrated the 7th anniversary of the Nexus Mutual Whitepaper. If you haven’t already, take a look at it here.

Thanks for reading, and see you next issue! 🌲

If you have any questions, reach out to us on the Nexus Mutual Discord.

Join us for the final DeFi Pulse Bi-Weekly call of the year on December 17, hosted on X Spaces via the Nexus Mutual account.

Happy new year and stay safe in DeFi!

Resources

If there’s a Protocol Cover or Bundled Protocol Cover listing you’d like to see added, reach out to us on Discord or send us a message through the Contact Form with your request for our Product & Risk Team to evaluate.

You can find the latest updates from the Nexus Mutual community below:

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below: