Welcome to the sixteenth edition of The Hedge!

This week, we provide a recap of Hugh's conversation with the UMA Protocol team about decentralized protection, the latest updates on SafeDAO Governance from BraveNewDeFi, and more community initiatives.

Let's get started.

Recap of Hugh Karp's conversation with UMA Protocol's Hart Lambur

On Wednesday, Hugh and Hart discussed the origins of traditional insurance, the current state of decentralized protection on-chain, the difference between parametric and non-parametric coverage, the areas in which Nexus Mutual is innovating such as ETH Staking Cover and the upcoming Directors and Officers (D&O) Cover, and Hugh’s vision for the future of on-chain protection.

They discussed the importance of trust-building and long-term consistency in the DeFi protection industry. Building a strong member base takes time, but now that Nexus Mutual has achieved this, Hugh highlighted the next big objectives for the mutual:

Scaling with new products that focus on underserved markets or niche areas that allow for parametric insurance (like recorded heat and wildfire protection)

Enabling members to build on the Nexus Mutual V2 protocol, launch new staking pools, develop new cover products, and participate in DAO governance

Developing effective distribution channels with global reach

It was a great conversation with Hugh providing plenty of insight about the mutual’s product development and scaling capabilities.

If you weren’t able to join, you can listen to the recording of the talk on Twitter.

Cover expiry alerts, capacity requests via Nexus Mutual Discord bot—coming soon™

The Community team has started working on the Discord notifications bot project, which was outlined in the Q1 & Q2 2023 team priorities proposal on the forum. BraveNewDeFi is working with underthesea—a fellow DeFi turtle and talented contributor—to build the notifications bot for the Nexus Mutual Discord.

Once this bot is launched, members will be able to opt-in to receive reminders to renew cover before it expires and request additional capacity for a cover product to ensure they are able to stay protected. The bot will also respond in the Nexus Mutual Discord server with key protocol metrics, such as available capacity and current spot price for a specific cover product.

The current goal is to launch the notification bots in mid-June. Stay tuned for updates!

[MetaGovernance] SafeDAO SEP #6: Safe Grants Program (SGP)

As a Safe Guardian, Nexus Mutual is represented in SafeDAO governance discussions and SEP votes. Since October 2022, BraveNewDeFi has acted as the mutual’s delegate in SafeDAO governance.

Over the last several months, SafeDAO members have discussed creating a grants program for the community, with the following work supported by Safe Grants:

Safe {Build} Grants

Safe {Growth} Grants

Safe {Research} Grants

Safe {Govern} Grants

SEP 6 was transitioned to a Snapshot vote on 3 May and closed for voting on 10 May, with the majority of SAFE holders voting to accept. BraveNewDeFi voted to accept SEP 6 and shared an update on the SafeDAO forum and on Twitter.

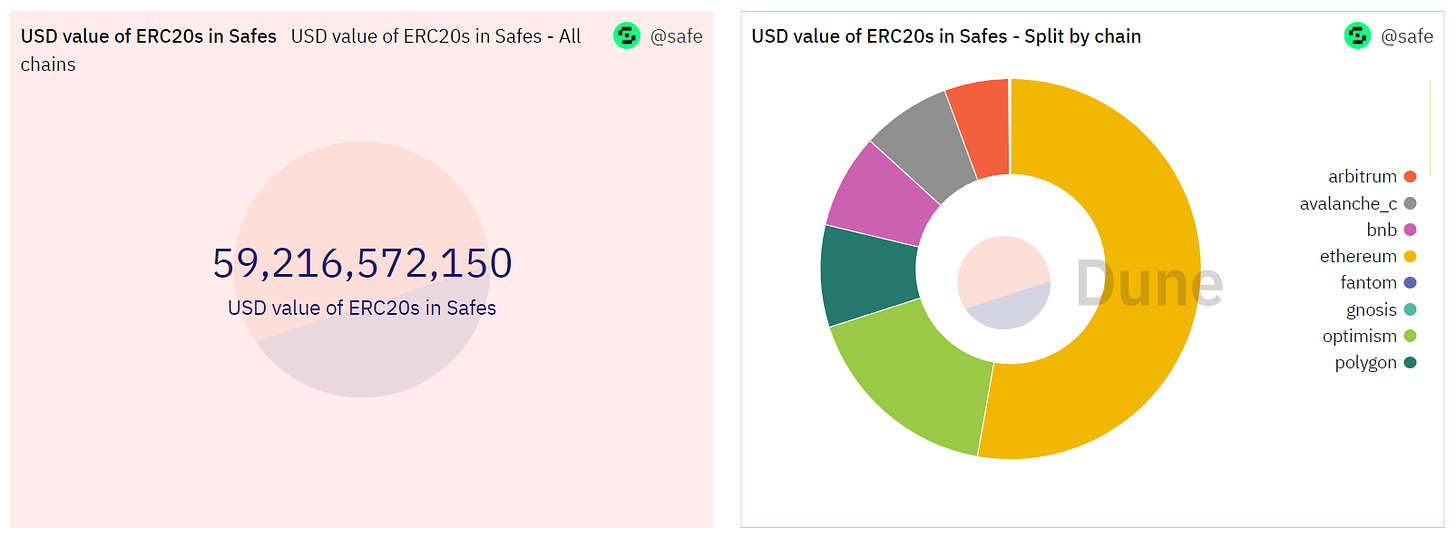

As the Safe community grows, the mutual can explore ways to further protect Safe multisig users and secure the growing value held in Safe smart contracts.

Source: Safe across chains Dune dashboard

New tokenomics project update

The Nexus Mutual Foundation and DAO teams reviewed the proposed tokenomics mechanics during a recent offsite in Lisbon; no major technical issues were identified, and for the next step, the engineering team will draft detailed technical specifications and proceed with development once this is complete. The Community team will work with the Foundation to ensure regular status updates are provided to members in future issues of The Hedge and on our community calls.

Please find Hugh’s detailed update in the previous issue of the Hedge.

Reminder: V1 → V2 NXM migration guide

If you had NXM staked in Nexus Mutual before V2 launched, you can withdraw it from the V1 smart contracts visible in the UI after connecting your wallet.

Please find a detailed guide on migrating your NXM in the last week’s issue of the Hedge.

Governance forum discussions

Avantgarde Treasury proposed to redeploy funds from the Enzyme vault, diversifying based on track record, geography, and monitoring risk elements.

Uisce.eth proposed that Nexus Mutual allocate around 10% of the capital pool to stake with Rocket Pool, the third largest ETH liquid staking token by TVL.

OpenCover requested feedback on the Blue Chip Protocol Staking Pool they have launched in partnership with DeFiSafety.

Tetiana introduced DAOsign, a contract management system for DAOs.

Review, comment, and get involved in the Nexus Mutual governance process!

An update from the Nexus Foundation Team

From the Community Call on 9 May at the Nexus Mutual Discord, Community Calls Voice Channel

The Foundation team is currently prioritizing the tokenomics project and developing sustainable growth strategies for the mutual. As previously mentioned by Hugh in last week’s issue, the team is making considerable progress on the new tokenomics project and has dedicated engineering support to tokenomics going forward.

To further accelerate adoption of V2 and growth in cover sales, the team is pursuing several approaches.

The Foundation is working with teams interested in launching new staking pools who have established distribution networks and unique distribution strategies. The Foundation will be focused on establishing robust distribution channels ahead of the next major wave of adoption.

Unity Cover—a staking pool built on Nexus Mutual—will be adding new products such as the directors and officers (D&O) cover to its pool offerings to drive cover sales. Unity Cover is also in talks with various teams interested in protecting their validator networks with ETH Staking Cover, given the growing interest of many institutions in staking on Ethereum following the Shapella network upgrade in March.

Teams will be experimenting with growth initiatives and strategies over the next six months to drive new cover sales and a boost in membership.

There’s a lot happening within Nexus Mutual. If you couldn’t join us on this week’s community call, you can listen to the recording on the Nexus Mutual YouTube channel.

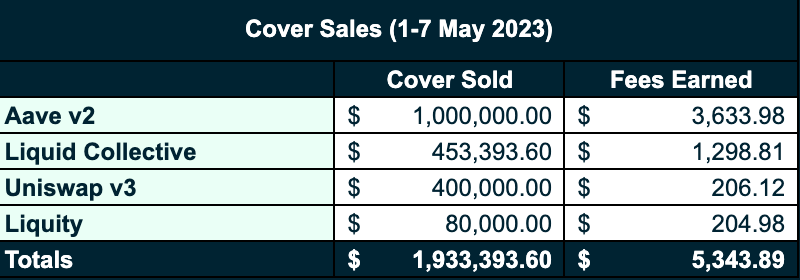

The Last Week in Review | 1–7 May 2023

In the last week, the mutual sold $1.9m USD worth of cover and earned $5.3k USD in fees, as outlined below.

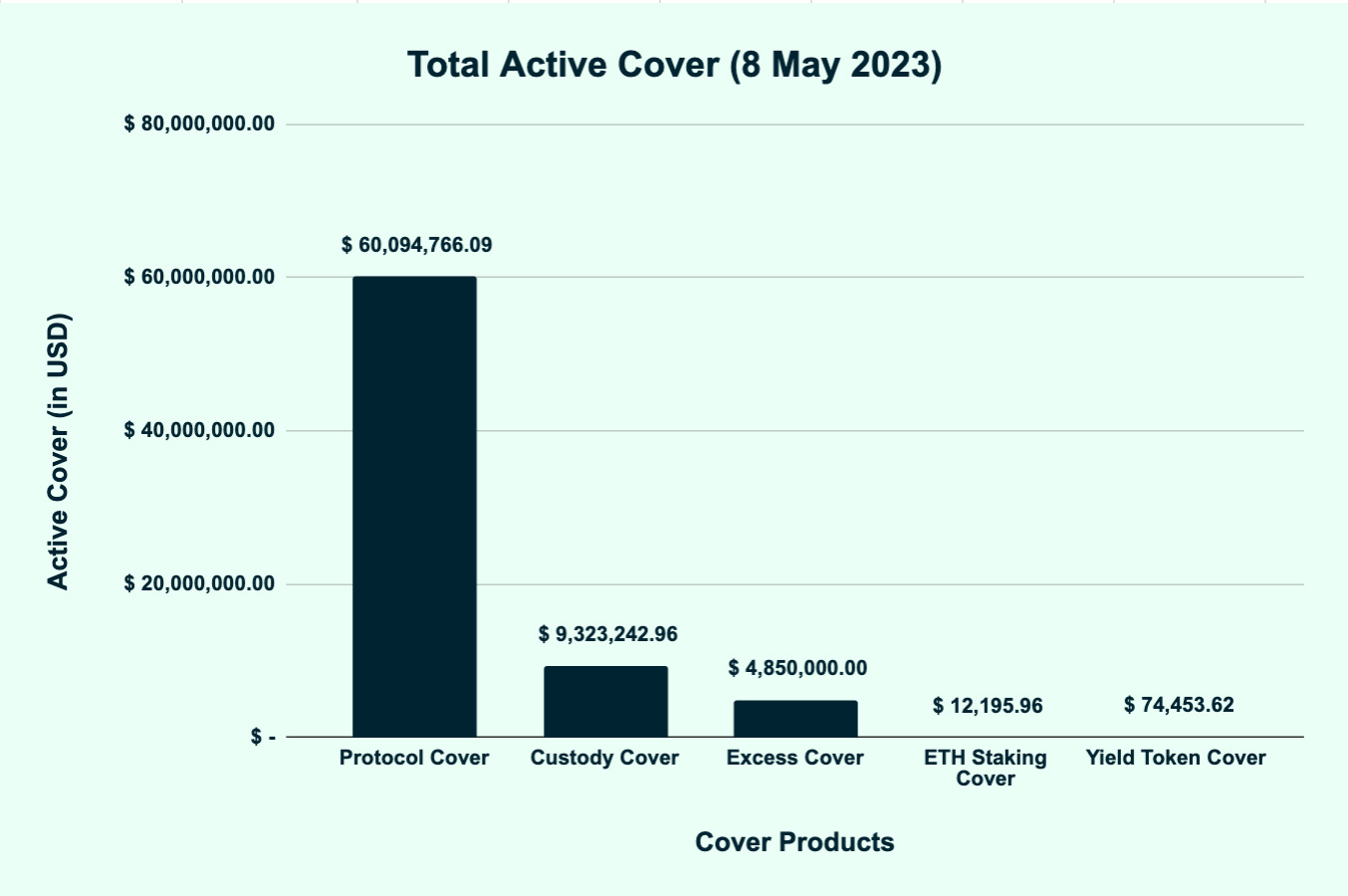

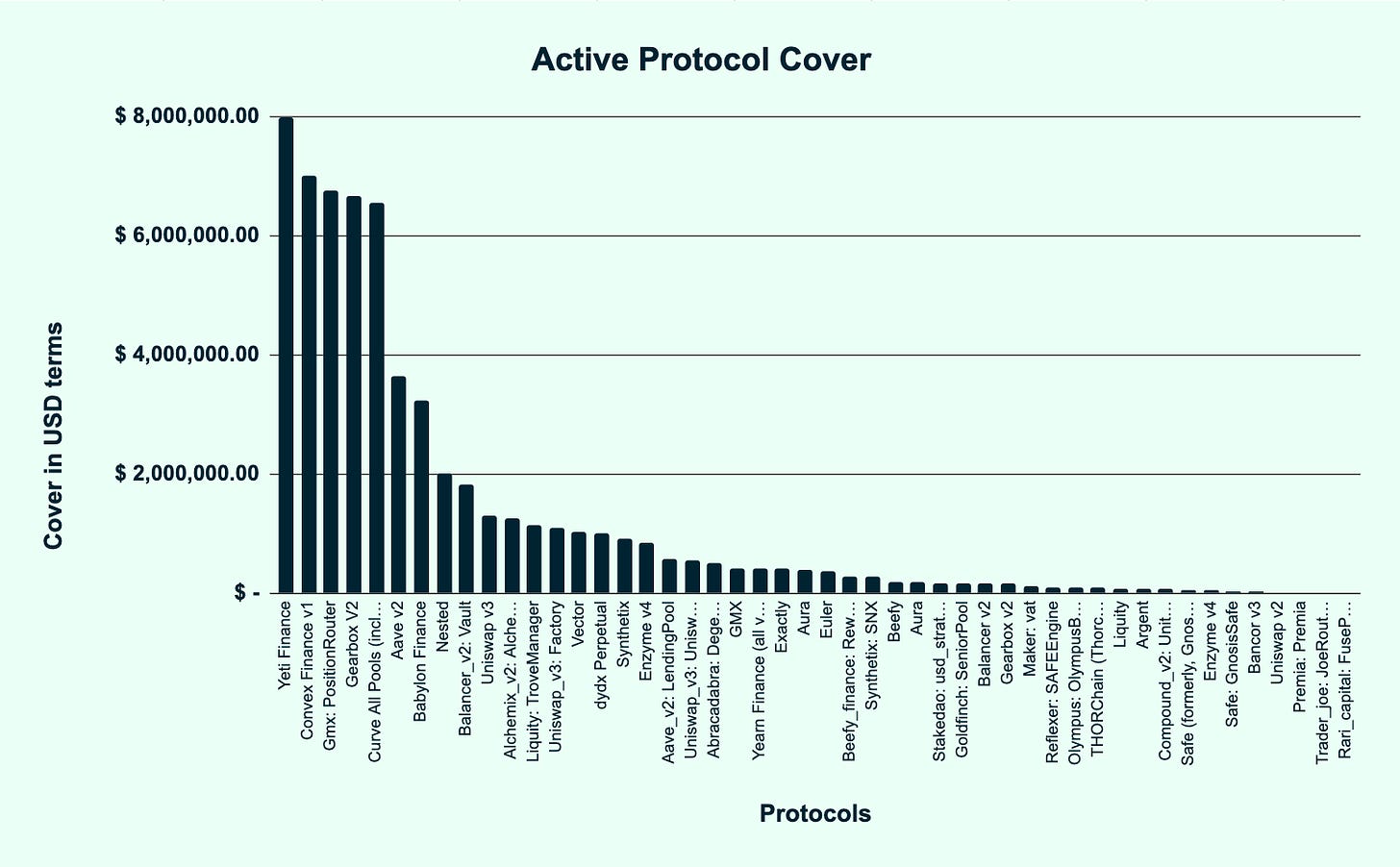

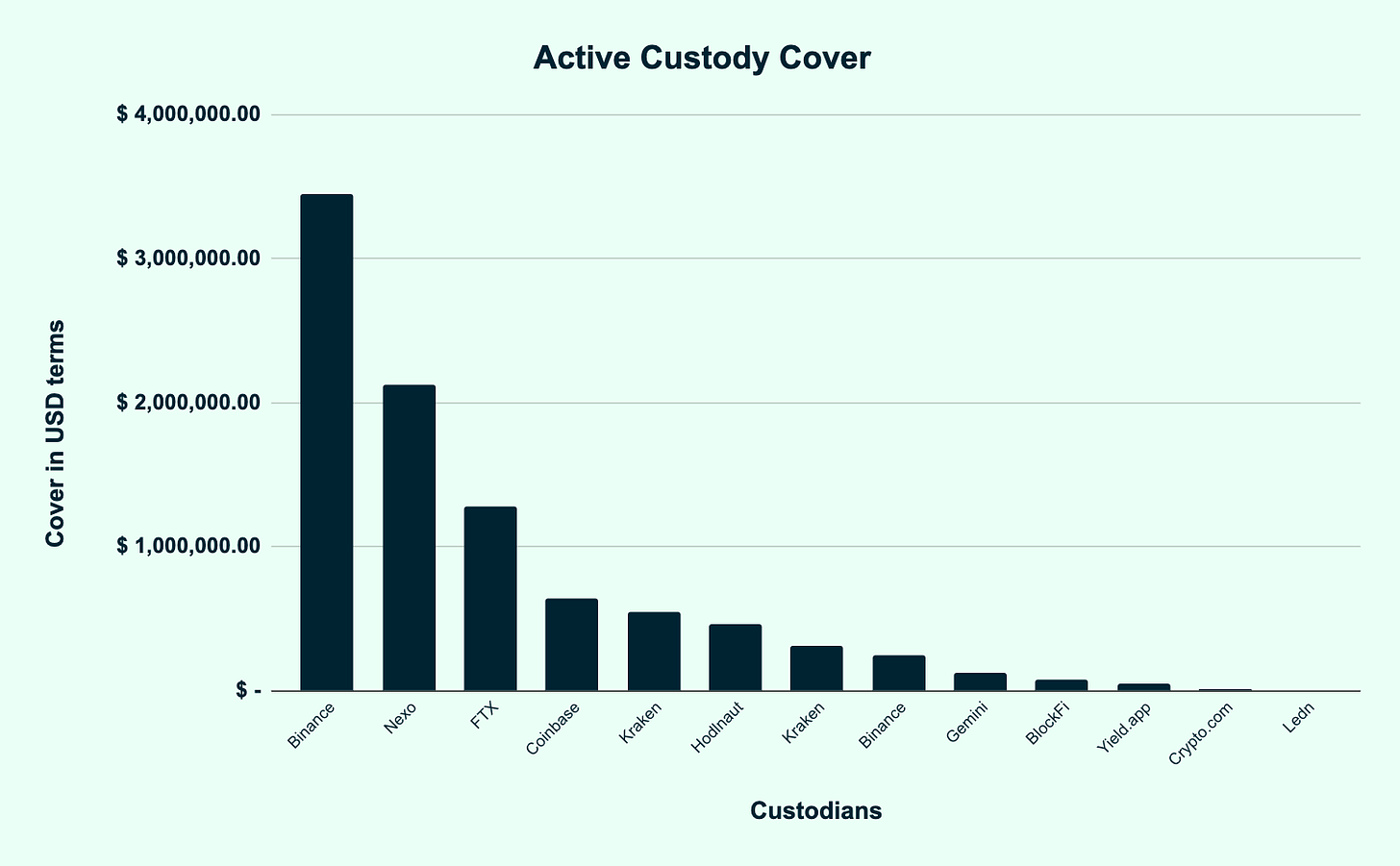

Active Cover as of 8 May 2023

Total active cover stands at $74.4m with active coverage by cover type as follows.

Up Next

Don’t forget to follow the Nexus Mutual Twitter account and Nexus Mutual Lens account for regular updates and announcements from the mutual.

Join us for our next community call on Tuesday (9 May) in the Nexus Mutual Discord! We’ll share the latest updates and provide an open forum for members.

Have a great week!

Resources

Nexus Mutual is fully transparent. You can verify the information within this newsletter and learn more about the mutual through the resources below.

Nexus Mutual Dune Dashboard for Capital Pool and Ownership, created by Nexus Mutual R&D and Marketing teams

Nexus Mutual Dune Dashboard for Claims, created by Nexus Mutual R&D and Marketing teams

Nexus Mutual Dune Dashboard, created by Richard Chen

Nexus Mutual’s community is most active on Discord. You may reach our team with any questions through LinkedIn and Discord.